The key in 2010:

BBVA has improved and stabilized its main indicators of credit quality

Significant progress over the year in improving portfolio credit quality: growth in lower-risk segments and reduction of more problematic portfolios in all geographical areas.

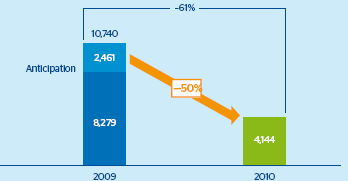

Reduction in new NPA.

Stability in outstanding NPA following the anticipatory provisions made at year-end 2009.

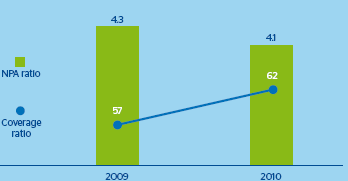

The NPA ratio has remained under control throughout the year, and has not exceeded the peak of December 2009.

The risk premium was down in 2010 on the figure for 2009. Nevertheless, the coverage ratio is still improving steadily from its low in December 2009.

By business area:

- South America and WB&AM are maintaining their NPA ratio in check and at historically low levels.

- Mexico is outstanding in terms of the positive trend in all its indicators.

- Spain and Portugal and the United States have managed to stabilize their indicators after several years of deterioration following the 2007 crisis.