Attributable economic risk capital (ERC) consumption reached €25,481m as of December 31, 2010, an increase of 14.3% compared with the same date the previous year (1) . The predominant risk type continued to be credit risk on portfolios originated in the Group branch-network from its own customer base, which accounted for 61.0% of the total. ERC for investment in associates has risen due to high market volatility and the increase of the stake in CNCB; the structural exchange-rate ERC has risen due to the high volatility of foreign currencies throughout the year. The weight of ERC from market operations is reduced by decreased exposure. ERC for operational risk barely varied over the year.

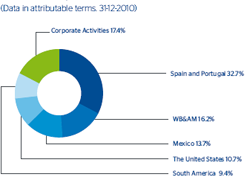

In the breakdown by areas, Spain and Portugal registered an increase in ERC of 8.3% due to the recalibration and revision of the models in the middle of the year. WB&AM increased ERC by 13.0%, basically due to the CITIC group. In Mexico, ERC was up 25.1%, partially offset by the appreciation of the peso. At a constant exchange rate, economic risk capital rose 9.4% as a result of better lending performance. There were no notable changes in ERC in the United States. In South America, it grew by 5.6%, basically because of the general strong loan-book growth in all the countries. Finally, ERC in Corporate Activities was 35.8% up, basically due to structural exchange rate risk and real estate risk.

The Group’s recurrent risk adjusted return on economic capital (RAROC), that generated from customer business and excluding one-offs, stood at 24.9%, reaching high levels in all business areas.

Finally, the economic risk capital ratios stood at 9.3% for adjusted core capital and 13.9% for total capital, both above their respective benchmark (6%-7% and 12%, respectively).