The mission of BBVA’s CR policy is to define and strengthen behavior that generates value for all its stakeholders: customers, employees, shareholders, suppliers and society. This is based on the highest levels of integrity and transparency.

The main commitments undertaken by the Group through its CR policy are as follows:

- Uphold excellence at all times in its core business operations.

- Minimize the negative impacts caused by its business activity.

- Create “social business opportunities” to generate both social and economic value for BBVA.

- Invest in those societies in which the Group is present through support for projects, especially those involving education.

In short, they are commitments aligned with the vision of “working towards a better future for people” and with BBVA’s principles.

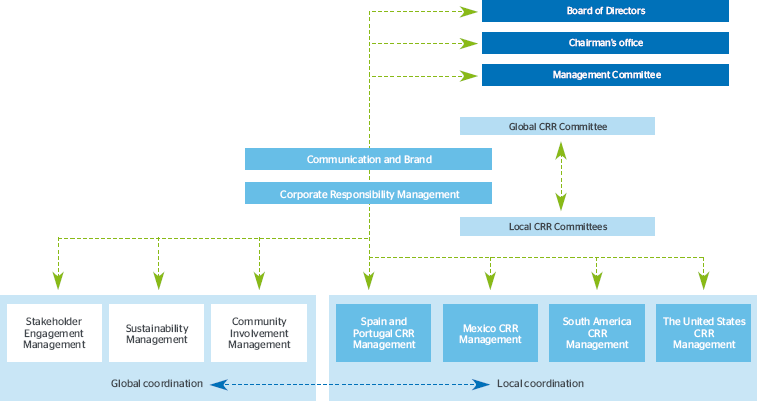

In terms of the organization of the CR function in the Group, corporate responsibility policy is approved by the Board of Directors, and the Corporate Responsibility department is responsible for managing and coordinating it. The Global Corporate Responsibility and Reputation (CRR) Committee formulates and monitors CR policy and programs. This body is made up of the executive managers of the Group’s main areas of business and support and chaired by the Brand and Communication manager (who in turn is a member of the Bank’s Management Committee). Each of the countries where the Group has a significant presence has also created a Corporate Responsibility and Reputation (CRR) committee with representatives from each of the local business areas, chaired by the Country Manager, who is the Bank’s CEO in each country. At the close of 2010 there were local CRR committees in Spain and Portugal, Mexico, Argentina, Colombia, Chile, Peru, Venezuela, Paraguay and Uruguay, as well as the Global Corporate Responsibility and Reputation (CRR) Committee. The Global CRR Committee meets at least twice a year, with the Group’s Chairman-CEO and President-COO present at one of the meetings.

Workshops designed to promote strategic reflection on CRR were held in 2010 in Spain and Portugal, Argentina, Chile, Colombia, Peru and Venezuela. Those participating included the main managers of the Group’s various business areas. The aim was to ground concepts and look for greater synergies in developing new CR initiatives.

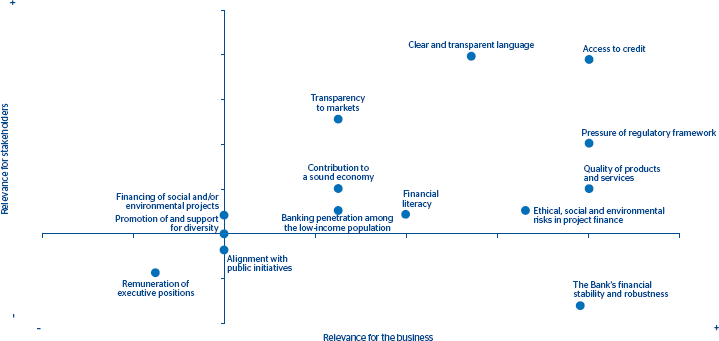

Within the application of CR policy, permanent dialog with the different stakeholders is essential for understanding and managing their different expectations and relevant events in a proactive, balanced and planned way. Thus customers’ opinions, their level of satisfaction and the handling of claims are all crucial. The same is true for employees and suppliers; analyses by investors, analysts and experts in sustainability; the initiatives of multilateral bodies and development banks; global corporate responsibility standards; growing legislative initiatives; and the opinion of labor unions, employers’ organizations, associations and NGOs. All these form a crossing map of issues that have to be managed. A proactive analysis will be made to determine what issues are and will be relevant in the medium term for a financial institution from the perspective of sustainability; what institutions are leaders in designing solutions; and who the ideal contacts can be for making a head start along this path. In 2010, fourteen issues were identified and analyzed as relevant for the Bank’s stakeholders and for the development of its business.

BBVA also continues to be committed to the main international agreements on corporate responsibility and sustainability, such as the United Nations Global Compact and the Millennium Development Goals, the UN Environment Program Finance Initiative (UNEP FI), the Equator Principles, the UN Principles for Responsible Investment (PRI) and the Carbon Disclosure Project. Furthermore, the Group publicly adheres to the United Nations’ Universal Declaration of Human Rights and the basic employment standards of the International Labor Organization, as well as the OECD Guidelines for Multinational Enterprises.

In an environment of financial and economic crisis, BBVA continues to strengthen its commitment to operate under the strictest principles of integrity, prudence and transparency. The Group is moving forward with actions based on the pillars of the Strategic CR Plan approved by the Board of Directors in 2008: financial literacy and inclusion, responsible banking and community involvement.