The Group’s market risk remains at low levels compared with the aggregates of risks managed by BBVA, particularly in terms of credit risk. This is due to the nature of the business and the Group’s policy of minimal proprietary trading. In 2010 the market risk of the Group’s trading portfolio increased slightly on previous years to an average economic capital of €353m.

The main risk factor in the Group continues to be linked to interest rates, with a weight of 61% of the total at the end of 2010 (this figure includes the spread risk). Equity risk accounts for 9%, a fall on the figure 12 months prior. In contrast, exchange-rate risk increased its weight slightly to 7%. Finally, volatility risk remains stable at 24% of the total portfolio risk.

By geographical area, and as an annual average, 64.5% of the market risk corresponded to the Global Markets Europe trading desk and 35.5% to the Group’s banks in the Americas, of which 23.0% is in Mexico.

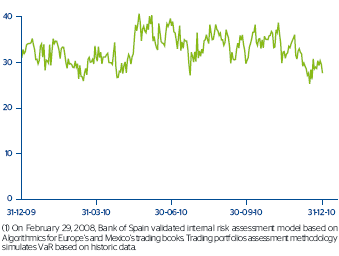

The backtesting comparison performed with market risk management results for the parent company (which accounts for most of the Group’s market risk) follows the principles set out in the Basel Accord. It makes a day-on-day comparison between actual risks and those estimated by the model, and proved that the risk measurement model was working correctly throughout 2010 (Chart 40).