BBVA: a paradigm of recurrent earnings, sustainability and strength

More than three years since the start of the crisis, BBVA continues to show an excellent capacity to generate recurrent and sustainable earnings and an outstanding strength that gives it the ability to take advantage of any opportunities that may arise. BBVA is a paradigm of: recurrency, sustainability and strength:

- Recurrent earnings and sustainability, because in an environment of great stress, BBVA is capable of maintaining stable earnings and leadership in efficiency and profitability. These earnings have also been compatible with a major effort in loan-loss provisioning and a high level of investment in the brand, franchises, people and technology.

- Differential strength, because the Group has a resistant, well capitalized balance sheet with risks that are well-known and controlled and with an adequate financing structure. Despite the pressure suffered by the financial system as a whole, the BBVA balance sheet has been characterized by strength in its risk, solvency and liquidity indicators. As a result, BBVA has not required any bail-out and hence avoided the generation of any cost to the societies where it operates.

In short, BBVA continues with its successful management of the four key levers of earnings, risk, capital and liquidity, under a strict code of conduct. This has been possible because throughout its history, the Bank has developed a winning business model that is focused on the customer rather than the product. It is universal and diversified, not only in terms of customer and product segments, but also business (banking, insurance, pensions, asset management, etc.) and geographical areas (Europe, Asia and the Americas).

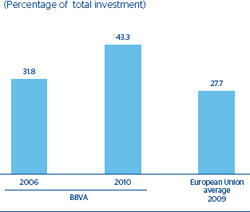

In all, the pillars of the BBVA business model are its customers, distribution, simple processes and technology. The Group’s banking model is based on creating value from close, lasting and mutually beneficial relationships with its customers. Its customer base is broad and diversified, with almost 48 million customers throughout the world. It is supported by one of the most extensive and closely integrated distribution networks on the planet making the bank accessible via any channel at any time. The emphasis is on simplicity, providing customers with products and services at the lowest cost and in the shortest possible time. This involves a new form of customer relations and a radical change in the internal processes of the Organization: in how things are done. Finally, BBVA continues to make a major effort in the area of technology. During the crisis, it has in fact been one of the few banks to increase its rate of investment in technology, with a priority on those projects that will transform the Bank.

This business model will enable the Group to be prepared for changes that are on the horizon, among them a new regulatory framework and a distinct competitive scenario.

The new regulatory framework

The difficult situation over the last three years has forced the financial sector to change the rules of the game to make it more transparent, probably smaller, better regulated and with a more significant role for the supervisory bodies. There has been a major boost to the regulatory agenda in 2010, on both a global and regional scale, with significant progress made on a number of diverse fronts:

Macroprudential supervision

Macroprudential supervision has become one of the major challenges for financial regulation at a global level. It aims to reduce the chance of a collapse of the financial system as a whole by mitigating systemic risk through the combination of existing tools and newer ones. For example, in Europe the authorities have taken a major step forward by approving a new financial supervisory framework through the new European Systemic Risk Council (ESRC). Starting on January 1, 2011, the European banking sector will have a new supervisor, the European Banking Agency, which is in charge of overseeing compliance with European Union regulations and making progress in harmonizing the national regulatory frameworks. The United States has created the Financial Stability Oversight Council and Mexico has set up its own Financial Stability Council.

Among the important tools for this macroprudential policy are the stress tests. In July 2010, the Committee of European Banking Supervisors (CEBS) coordinated an exercise using these tests. The published results were well received by the financial markets very positively. They also valued the outstanding robustness of the Spanish sector, with the test covering the 95% of the assets of the financial system, and the high level of transparency provided by the Bank of Spain, thus enabling the clearest possible discrimination between banks. In the case of BBVA, the publication of the results of the stress tests confirmed the Group’s strength as one of the soundest and solvent banks in Europe. The fact that the exercise will be repeated in 2011 is welcomed very positively by BBVA.

New regulations

The new regulations to be introduced include a process of international standardization on a number of fronts, including solvency, liquidity, leverage, transparency and remuneration policy. The objective is to transform the financial system into one where business is more secure and recurrent and less procyclical; with greater risk coverage and returns better adjusted to the risks assumed; more solvent and with greater quality of capital, transparency and consistency; and with a better, liquidity position and less leveraged.

Basel III basically regulates solvency, liquidity and leverage. With respect to solvency, financial institutions will have to increase the quality and quantity of capital they hold according to the risks they assume in their activity. In addition, a procyclical provision may be required when there is excessive growth in aggregate lending. New liquidity requirements have been added to these capital requirements. The aim is to ensure that the banks have sufficient cash or equivalent to overcome a very severe short-term scenario, with less severe conditions in the long-term. It also establishes leverage limits.

All of these measures have an introductory period for their implementation beginning in 2013 and ending in 2018. The banking industry is thus faced with a few years of major challenges in which to adapt to the new regulations. In the specific case of BBVA, the Group is in a comfortable situation to comply with the new Basel III regulations and face future crisis scenarios in a more secure position:

- It is among the best capitalized international institutions thanks to its quarter-by-quarter organic capital generation.

- This position has also been strengthened after its recent successful share capital increase. With this operation, BBVA has once more demonstrated its capacity to be proactive; it has anticipated possible future capital increases by other banks designed to ensure compliance with the new solvency requirements.

- It has a balance sheet with fully known and limited risks.

- It has a comfortable liquidity position and adequate leverage, complying with all regulatory requirements.

With respect to the new remuneration framework, both governments and regulatory authorities in the countries most affected by the financial crisis have introduced various measures designed to ensure that the variable remuneration systems are adapted to the level of risk assumed. Specifically, within its project to modify Directive 48/2006, the European Commission has decided to include all the Financial Stability Board’s (FSB) Principles for Sound Compensation Practices. Among the main new points are that the Bank of Spain will carry out monitoring and supervision duties, and sanction those banks that do not comply with the regulations as approved. The Sustainable Economy bill also expressly mentions the new requirements regarding the question of remuneration. Specifically, recommendations are included for remuneration policies that are coherent with a prudent and efficient risk management and that increase transparency and improve corporate governance by imposing greater control on executive remuneration. In this respect, it is important to point out that BBVA’s remuneration system complies with the recommendations of the proposed law. Its variable compensation policy for the executive team, based on a prudent and efficient risk management and with payments on the short, medium and long term, complies with these requirements. For BBVA, this system represents a competitive advantage, as it optimizes the relationship between value generation in the medium and long term and efficient risk management.

Finally, another of the fronts on which progress is being made is the creation of a crisis management and resolution framework for global banks when these are no longer solvent. Throughout 2010, the regulators have taken significant steps through the reform of Dodd-Frank in the United States, and through a formal European Commission proposal in Europe, whose final version will be published in the spring of 2011. These moves include the aim to implement tougher capital requirements for systematically important financial institutions. Currently, BBVA already has most of the instruments proposed in the regulations approved, thus contributing to the stability of the financial systems where it operates and also anticipating the regulatory challenges scheduled for the coming year. Any efficient solution must create the right incentives for achieving financial stability at a global level. Simplistic measures based only on size must be avoided, and various mitigating factors should be included in the proposed solutions: the business model; the complexity of the organizational structure; the existence of subsidiaries with decentralized liquidity management; the intensity of supervision; the quality of corporate governance; and strong market infrastructures. These factors allow prudent banks that operate in accordance with the objective of financial stability to be distinguished from those that do not.

The new competitive scenario

In addition to the above, the sector will have to face another more deep transformation that will require a great innovative effort of the banks.

Technological, social and economic changes that have redefined the form in which other industries operate will also be the drivers of change in the banking system in the future. In the medium term, a completely new playing field is expected for the industry with new actors making an appearance (more technological, with new proposals, more flexible, etc.), new forms of banking (new added value proposals) and new forms of relationships and distribution. The banks that understand and adapt to this change will be those that register the greatest future growth.

BBVA is prepared to lead this new phase for the financial system

We are prepared for this new phase because BBVA’s management has always been, and will always be, the embodiment of proactive and prudent policy. Prudent, because all decisions have been taken based on exhaustive and precise measurement of returns adjusted to the risks assumed or that will be assumed. This premise is the basis for the construction of a balance sheet with limited risks and great structural strength and that is prepared to comfortably assume any upcoming regulatory changes. At the same time, it has enabled us to overcome the crisis without the impacts experienced by most of the financial industry (for example, without exposure to toxic assets). And proactive, because this capacity to anticipate events has been key to the Group’s performance in these difficult years. It will continue to be instrumental in an increasingly global and uncertain future.

BBVA also has a good level of diversification. Recurring earnings are, to a large extent, the result of a portfolio that is diversified in terms of geography, business and customers. Today, more than 58% of the Group’s earnings come from America and Asia, regions in which BBVA operates through leading franchises. This allows the Group to take better advantage of the opportunities in each economy.

In line with its proactive stance, BBVA never loses sight of the management of the Bank’s future and the need to anticipate events. In 2010, the Bank implemented new projects with the aim of strengthening its position after the inevitable discrimination that will result from the new environment and its difficulties. With this objective, it has worked on three elements in particular:

- An organic growth plan, based on addressing a more complicated environment and anticipating new demands from more demanding customers.

- Consolidation of the business approach in the different areas, by anticipating and accompanying the changes within the new scheme of global economic growth.

- Maintenance of the structural strength of its balance sheet.

The BBVA franchises

The BBVA franchises share the Group’s business and management model. However, each franchise is at a different stage of development and at a different moment in the economic cycle. Each thus, has different specific priorities.

- Spain and Portugal has demonstrated a great capacity for anticipation, which has enabled it to fare the crisis in better conditions than its competitors. This puts BBVA in a good position to take advantage of the opportunities that will emerge in a market undergoing a restructuring process, where major differences will emerge between strong banks and the rest. The launch of “Plan Uno” has been an extremely important step in the commercial strategy of the area, which continues to be moving towards an increasingly customer-focused organization. In 2011 the focus will continue to be the personalized management of the customer base, increasing customer loyalty, and the development of new channels for customer convenience with the possibility of customization.

- The leading position of the BBVA franchise in Mexico will enable it to take full advantage of the economic recovery and the opportunities for extending banking penetration in the country. This was the aim of the Strategic Growth Plan 2010-2012 launched this year. This plan will lead to a qualitative transformation of the business model, service, commercial efficiency, control and monitoring of activity and risk, and thus the Bank’s profitability as a whole. Mexico is currently in a position to construct “the bank of the future”, with a basic focus on customers and a different way of relating to them.

- The South American franchise is also expected to continue its good performance, as it has throughout the whole crisis. Regional leadership in this area must be used to reinforce the local positioning of each bank within each country. The management priorities for 2011 will be focused on the customer base (new customers, growth, loyalty and market share), the progress with the customer insight and business intelligence models, increased commercial productivity, maintenance of efficiency in the pension business and continued development and improvement of a multi-channel approach. Growth will also be based on both technological and management innovation.

- The United States. This is one of the Group’s strategic markets. Deployment of BBVA’s business model and technological platform is being steadily extended in this area, with clear operational improvements every quarter. As a result, the weight of the relative contribution of this franchise will gradually increase. A differentiation plan will be implemented in 2011 that is capable of supplying the products and services required for the needs of the Bank’s different customers through the appropriate channels. And, of course, technology will play an important role in all of this.

- China and Asia. The results in terms of earnings and the Bank’s commitment to the region have begun to register in 2010. In the medium term the contribution of this area is expected to increase even more thanks to the multiple initiatives that are being undertaken in the area.

- Wholesale Banking & Asset Management (WB&AM) will continue to enhance its model across the rest of the areas, based on globalization, strong customer relations, and improved product capacities and innovation.

- The strategic alliance with the CITIC group will continue to be strengthened in the Asian region by developing the collaboration agreements already in place and searching for new opportunities.

A further step was taken in 2010 to diversify BBVA’s business, in line with the new frame work of global growth, through the agreement to acquire 24.9% of Garanti in Turkey. This gives BBVA entry into one of the emerging markets with the greatest growth potential and one of the best banking franchises in the country. In this respect, it is worth noting the good earnings figures reported by the Bank for 2010, with a net attributable profit up 6% year-on-year to all-time high. The driving force of growth continues to be the excellent performance of the lending business, which was up 31%, even though asset quality was not negatively affected. In fact, the NPA ratio and risk premium improved over the year. Garanti strengthens the business portfolio and BBVA’s growth profile. Similarly, Garanti benefits from BBVA’s experience in market and product development. In other words, BBVA’s experience of similar successful deals concluded in other markets (above all, Latin America) gives it the capacity to boost Garanti’s growth in the future.

BBVA always focuses on its customers

These times of uncertainty and change demand that all financial institutions that hope to prevail be readily able to adapt. But this environment also represents a great opportunity for BBVA. It has implemented numerous proactive plans and initiatives to ensure transformation and growth. But at least one thing will remain unchanged: our commitment to our customers and the society in which we operate. Our aim is to support them even in the most difficult circumstances. This appears simple, but today it is only within the reach of a few banks. At BBVA we are proud to be one of these few.