In 2010, the ability to generate capital continued to be a crucial factor for the financial sector, as is made clear by tests undertaken by a number of bodies such as the Committee of European Banking Supervisors (CEBS) to check the capital adequacy of banks under situations of stress. The results of the stress tests carried out by the CEBS were published in July. They revealed that BBVA is among the best banks in Europe, with not only an excellent capital adequacy level but also the capacity to face situations of maximum stress in a time horizon of two years.

The year 2010 was characterized by two factors. On the one hand, it was a year with a low level of capital issues, given the difficulties in the financial markets, affected by tensions caused basically by uncertainties on the sustainability of public finances in some European countries. On the other hand, in 2010 the Basel Committee also issued several consultation documents relating to the new Basel III regulations. There are still someuncertainties about the characteristics that will be required of capital instruments to be considered as Tier I capital under Basel III.

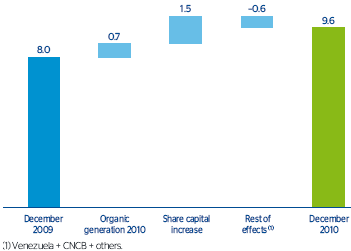

Given this situation, it is important to stress that BBVA has organically generated capital quarter by quarter. What is more, the Group’s capital base as of December 31, 2010 has been strengthened by the successful share capital increase of €4,914m in November 2010 to finance the acquisition of a 24.9% stake in Garanti planned for the first half of 2011.

BBVA closed 2010 with a net attributable profit of €4,606m, of which €1,079m were distributed to shareholders in cash through three interim dividend payments amounting to €0.27 per share. Retained earnings in 2010 were €3,527m, with an organic generation of core capital that has more than offset ordinary expenses and extraordinary net investments during the year.

In terms of expenses, it is important to remember the negative effect of the devaluation of the Venezuelan bolivar in January 2010. With regard to investments, the Group has continued its expansion plan in Asia. In the second quarter, it exercised its purchase option for 4.93% of CNCB to increase its stake to 15%. The total amount of investment as a result of the exercise of this option was about €1,200 million. This has had a negative impact of 20 basis points on the core capital, due to the goodwill generated of around €600 million.

As a result of all the above, as of December 31, 2010, the eligible capital of BBVA, calculated according to the Basel II capital agreement rules, was €42,924 million, €3,484 million more than on 31-Dec-2009. Over the year the RWA increased by 7.7% to €313,327 million, 56.7% of the Group’s total assets.This increase is largely the result of general currency appreciation. With these RWA, the capital requirements (8% of RWA) stand at €25,066 million. Thus, there is a capital base surplus of €17,858 million, 71.2% above the minimum required, which reflects the Group’s sound position.

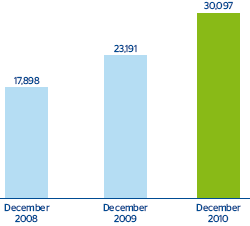

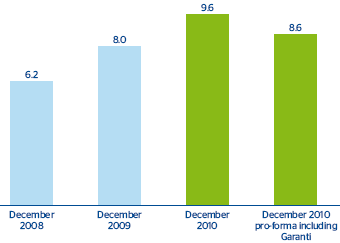

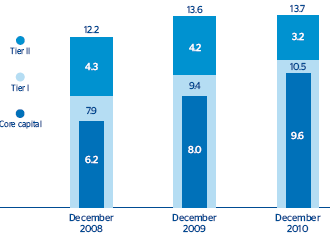

Core capital at the year-end stood at €30,097 million. The core ratio was 9.6%, up 164 basis points, of which approximately 70 correspond to organic capital generation and 150 are from the aforementioned capital increase. Of this amount, 60 basis points are basically the result of the exchange-rate effect (including the devaluation of the Venezuelan bolivar) and the exercise of the purchase option on CNCB. It is important to note that including the effect of Garanti’s acquisition in a pro-forma basis, this core ratio would be 8.6%.

If preference shares are incorporated into the core capital, Tier I increases to €33,023m, 10.5% of RWA, compared with 9.4% in the previous year. The amount of these preference shares closed the year at €5,164m. They account for 15.6% of bank capital (Tier I), compared with 18.8% the previous year.

Tier II capital, which includes mainly subordinated debt, eligible unrealized capital gains and surplus generic insolvency provisions, closed the year at €9,901m. This amounts to 3.2% of RWA, 100 basis points below the figure for 2009. This ratio has fallen basically due to the lower unrealized gains and the increased deduction for the purchase option on CNCB. It is important to note that BBVA Bancomer completed a USD 1,000 million subordinated debt issue and BBVA Chile one for 5.6 million Unidades de Fomento (€180m). Both issues are calculated as Tier II in the Group’s capital base and have a positive impact on supplementary bank capital.

As a result of all the above, the BIS II ratio remains high, at 13.7% of RWA at the close of 2010, a rise of 15 basis points on the figure 12 months prior. To sum up, BBVA has a place among the group of best capitalized financial institutions, thanks to its organic capital generation and successful capital increase. This puts it in an outstanding position to meet the new Basel III requirements.