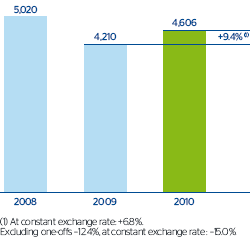

In 2010 BBVA generated a net attributable profit of €4,606m, an increase of 9.4% on the figure for 2009.

The following are earnings highlights for the year:

- Elevated capacity for generating revenues, as reflected by the accumulated gross income, the highest in BBVA’s history, of €20,910m. This is especially relevant considering the still complex economic backdrop of the year.

- Increase of diversification, in geographic, business and segment terms, which makes the earnings depend on multiple economies, currencies, sectors and risk factors. In terms of geography, today 58.1% of the Bank’s gross income comes from the Americas and Asia, where BBVA operates through leading franchises that compensate the lesser contribution of Spain. In terms of business, the weight of earnings from units without liquidity or credit risks, such as those managing mutual funds and pensions or insurance, are relevant, as they contribute stability to earnings of the banking business, as they are more cyclical. Furthermore, the Group has specialized units in the different segments of individual customers, SMEs, national and multinational corporations, governments and administrations and financial institutions. This diversity is managed through transversal responsibilities of the geographic areas and businesses.

- Launch of an ambitious investment plan with the objective of initiating a new path of growth in each of the markets in which BBVA operates. The above has impacted the course of operating expenses (up 7.3% year-on-year, but up 5.4% at constant exchange rates).

- Positive progress of provisions. After the anticipatory provisions made in the fourth quarter of 2009, the impairment losses on financial assets in 2010 fell by 13.8% as a result of BBVA’s superior risk management. It is also worth noting that the NPA ratio and the coverage ratio improved over the year to 4.1% and 62%, respectively (from 4.3% and 57% at the close of December 2009).

- General appreciation in currencies with the biggest impact on the Group’s earnings. The exceptions are the Venezuelan bolivar, which devalued in January, and the Argentinean peso, which depreciated slightly over the last twelve months in terms of average exchange rates. In all, the effect of the exchange rates on the year-on-year comparison of the Group’s income statements and balance sheet is positive.

BBVA’s profitability compares favorably with standards in the sector. The Group maintains an outstanding position in terms of average total assets (ATA) with respect to the main items on the income statement. Thus the net interest income over ATA stands at 2.38%, which though below the figure in 2009 is above the 2.26% in 2008. The main causes of this development, apart from the growth of 2.9% in ATA (mainly due to the general appreciation of exchange rates), are the restriction of the net interest income caused by the rise in interest rates, more expensive wholesale funds, and the steady change in the composition of the portfolio, as explained below. However, the greater contribution of net trading income (NTI) and the other gains/losses items has reduced the gap between 2010 and 2009 in terms of gross income over ATA (3.74% in 2010 compared with 3.81% in 2009). Increased lending over the year has reduced the operating income over ATA by 13 basis points to 2.14% (also above the 2008 figure). Finally, the positive trend in loan-loss provisions and provisions (net) and other gains/losses explains why ROA stood at 0.89% (0.85% in 2009).