This unit manages the financial and non-financial demand of households, professionals, retailers and small businesses and manages a business volume of €214,577m and a net attributable profit of €1,317m, accounting for 61.3% and 63.6% of the area as a whole, respectively.

The Retail Network has been a model in the market in terms of granting mortgage loans, attracting stable savings, in its main profitability and productivity indicators, and in the stability of its efficiency ratio. This has been in a year where there has been a clear tightening in the business volume and earnings. The increase of cross-selling to 3.7 products per customer, greater loyalty, improvement of credit spreads (more relevant in the second half of the year) and cost control have all contributed to an operating income of €2,190m, more than 7 times the total loan-loss provisions.

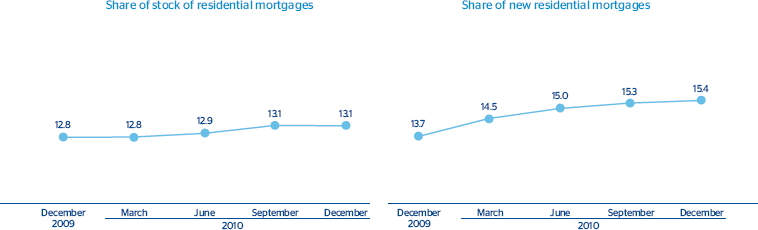

The launch of the aforementioned Plan Uno attracted 400,000 new customers and improved the structure of the customer base, as it increased the proportion of customers with services contracted or with current and deposit accounts by 138 basis points. With respect to the loan book, residential mortgage lending performed particularly well, with 5.1% more loans granted over the year. The unit has improved its positioning in this segment for the second year in a row thanks to campaigns such as Sí, damos hipotecas and Ven a Casa, and by arranging 6.1% of the total online through the Hipoteca On line BBVA scheme.

In a context of slowing demand for consumer finance, BBVA offers special conditions for certain groups and has launched a commercial campaign providing an offer of free comprehensive insurance with each car loan. As a result, it closed 2010 as the leading supplier of this type of loan, with an average monthly lending of €129m and a 10.9% market share in managed stock as of 31-Dec-2010.

Another noteworthy aspect was the significant gathering of transactional funds, whose balance rose to €29,826m as of December 31, 2010, primarily due to the commercial initiatives carried out, including: the launch of Cuenta Uno, which has become a new reference for transactional clients in the individual segment, and the Ventajas Uno transactional schemes within the Aprovecha tu banco initiative in which clients who direct deposit their salaries are exempt from paying maintenance fees and commissions on their accounts. Also noteworthy are the two new “Quincenas del Ahorro” (Two Weeks of Savings), with €1,636m captured and more than 464,000 gifts given; the various campaigns developed for capturing paychecks and salaries, which have increased new direct payments by 168,000 and the capture of new customers, as approximately 47% of those who took advantage of these offers were not previously customers of the Entity. The gain of 157 basis points in the year for the market share in term deposits, is due primarily to the capture of 12,795m since March 2010, making the unit’s managed stock €40,381m. Products such as BBVA Uno, Depósito Líder, and Depósitos Crecientes have proven to be a solid response to increased customer demand for this type of product.

Finally, there also was a notable participation by the branches network in the Group’s share capital increase in November 2010, through which it attracted €1,300m. Stable resources (deposits, mutual funds, pension funds and fixed-income) amounted to €112,261m.

BBVA Private Banking closed 2010 with funds under management in Spain of €38,944m, up 5.8% year-on-year, and with a growth of 5.6% in its customer base due primarily to the internal and external capture plans carried out and the strengthening of the BBVA Private Banking brand. At the same time, it continues to be the market leader in SICAV, both in terms of assets under management (€3,017m) with a market share of 11.8%, and in the number of companies (296). The unit’s core activities for 2010 have been technological renewal (thanks to the development of a new platform of systems and new channels), staff training, the implementation of Planifica (the tax optimization tool) and the new center for investment solutions that centralizes the private banking service. It has also been granted the two biggest awards as the best private bank in Spain from Euromoney and The Banker (the Financial Times group) for its management model, adaptation to new regulations, investor confidence and innovation in improving customer service.

The various commercial actions carried out in 2010 in the SME and retailer segment (which includes the self-employed, farming community and small businesses) include: the plan geared toward retailers, with exclusive offers, such as the Bono TPV PoS Voucher, which has led to an 10% increase in the number of stores and exceeds the market in the increase of PoS terminal revenues, up 13.2% from January 1, 2010 (a 5.8% increase in all the companies linked to Servired up to the same date). Likewise, the launch of the Plan Más Profesional has resulted in the capture of 2,500 high-value professional clients with over €200m in revenues. In addition, within the framework of the Plan Rain, mention should also be made of the placement of €815m in ICO credit lines through the signing of 27,613 operations over the year. In particular, the ICO Directo line has granted €70m to SMEs and the self-employed in 1,600 operations. The signing of collaboration agreements with franchises including McDonald’s, Burger King and the Rodilla Group have also contributed positively and have made BBVA the leading Entity as it offers a new, more specialized and supervised manner of studying the opening of new businesses. Finally, in the agricultural segment, the Bank has processed agricultural subsidies from the European Union in 2010 through the bank accounts of 48,300 farmers (43,000 in 2009), worth €204m, 10.3% more than in 2009.

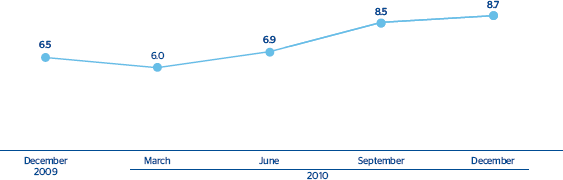

In 2010, the payment channels business began to recover its levels of invoicing and transactionality. The stock of credit cards stands at nearly 9.7 million, of which 75% are financial and the rest are private or co-branded. The Tempo family of credit cards, which simplifies BBVA’s range, has been widely accepted. The above has allowed BBVA to improve its market share in credit card stock to 9.0% as of September 30, 2010 (8.7% as of December 31, 2009). New, more efficient ways of interaction with the customer have also been launched, such as the option to pay for a purchase using a mobile phone, or to add money to a prepaid card through the BBVA.mobi mobile portal. Furthermore, BBVA continues its transition to EMV to improve transaction security.

Within the framework of the multi-channel business, the new bbva.es website was launched in March. Its primary attributes include: simplicity, innovation and transparency, in addition to incorporating important advances in customization and ease in the analysis of the customer’s global finances. This banking website is a pioneer in Spain regarding the application of these concepts, which have resulted in a very positive evaluation from the Forrester Research Institute. Visits to the website were up 17% in the year, to 81 million, and logins to private pages increased 28% over the same time period. Connectivity was further consolidated through the mobile phone and other new devices, like tablets. BBVA was also a pioneer in the launch of an iPad application geared towards the private banking customer segment. The self-service line finalized the implementation of a new application that makes operating simpler, faster and more secure, and 800 new ATMs with deposit modules were installed, resulting in the surpassing of the one million mark for monthly deposits via this channel. Finally, the telebanking channel, which continues to consolidate the management model and has started work on the design of its new technological platform, obtained awards for Excellence in customer service, as part of the First Session of the Contact Center awards, and for the Best Banking Transaction and Financial Services (CRC Oro Awards).

The Promotion and New Business Models unit, which manages non-financial services, has participated in 2010 in 85,000 operations for a total of €80m in sales.