Risk management in insurance serves a fourfold purpose:

- Identification, calculation, monitoring and management of the risks of catalogued and new products in Group companies which operate in this activity. The methodology used must be validated at the corporate level.

- Inclusion of the risk premium into product prices as the first step in contributing to the solvency of the business.

- Setting limits and controls in line with the targeted risk profile of BBVA, while adapting to the specific features of insurance products (maturities, underlying assets and the necessary actuarial calculations).

- Risk overview, taking into account the business units’ information requirements and those of the different regulators.

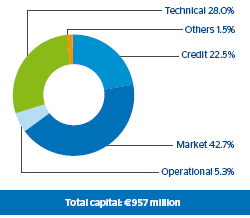

Economic capital in insurance activity in 2010 came to €957 million, a similar figure to 2009. Economic capital by market risk represented 42.7% of the total, followed by technical risk, accounting for 28.0%, credit risk 22.5% and operational risk 5.3%.

Asset Management

Governments have been the leading players in 2010. The economic downturn and the high levels of debt of some countries in the Euro zone have heightened tension to such an extent that it has even sown doubt in the markets about the sustainability of the European Union. This year the flight to quality is a flight towards non-peripheral sovereign debt, leading to increased risk premiums among peripheral countries and as a result raising the cost of financing.

In this situation, the extreme competition for savings in the banking system in Spain has led to a large proportion of the assets held by funds to be reduced by transfers to deposits. Once more, in a difficult year featuring extreme volatility of debt, contagion in stock markets, liquidity and reimbursements, the aim has always been to adapt to the environment with positioning in safe instruments that guarantee customers liquidity. This has involved appropriate diversification in the portfolios under management. BBVA is comitted to its fiduciary duty towards its customers, and to assuming exclusively the risks in third-party portfolios that can be correctly identified, measured, monitored and managed.

Economic capital in the Asset Management unit stood at €71 million. Market risk accounts for 58.1%, with €41 million attributable basically to guarantee risk. Operational risk stood at 41.6% of the total economic capital in the unit.

Pensions in the Americas

The pensions business in the Americas has continued with natural growth from contributions by participants, which consolidated and increased the volume of funds under management. Asset prices also improved.

From the perspective of the corporate model, the management and control structure of the risks of this business has been strengthened with the creation of a global risk management unit for pension and insurance activities in the Americas, within the scope of South American risks. This provides a cross-cutting perspective that is close to the business.

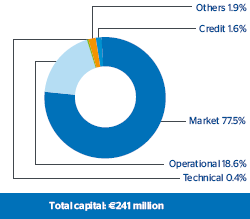

The economic capital of the pensions business in the Americas is estimated at €241 million. Market risk, essentially resulting from the position of regulatory match (related to the volume of funds under management) accounts for 77.5% of the total economic capital. Next comes operational risk, at 18.6%, less than in 2009, as the Basel methodology was introduced.

Real estate business risk

Throughout the year, the risk model corresponding to BBVA real estate activities has been implemented, using the Group’s common metric: economic capital.

The model establishes different categories of risk according to a segmentation of attributes such as type of asset, project phase, geographical area, and other exogenous factors. The risk in each position is evaluated by simulating price variations according to parameters characteristic for each project, such as volatility, liquidity and trend. These parameters are based on historical series and estimates or projections made within the BBVA Group by specialized units.

Once the capital for each individual project has been calculated within a confidence level of 99.9%, it is aggregated and diversified among all the projects in the portfolio. The results obtained are coherent with the current situation of the real estate market.

The economic capital of the real estate business is integrated into the BBVA Group’s capital map.