The net attributable profit stood at €4,606m, an increase of 9.4%. Not counting the oneoffs of the previous year, €1,050m, the annual variation is at –12.4%.

Once again, all the Group’s business areas have positively contributed to its generation. In this regard, Spain and Portugal generated €2,070m, Mexico €1,707m, South America €889m, United States €236m and WB&AM €950m.

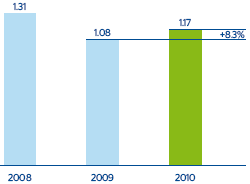

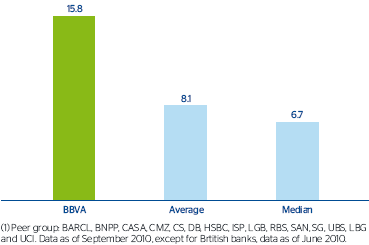

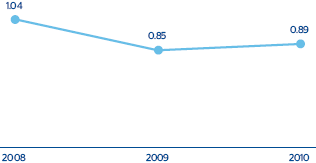

The share capital increase in November did not dilute basic earnings per share, which stood at €1.17 in 2010 and was up 8.3%, a growth rate close to that of the net attributable profit. The book value per share stands at €8.17, up 4.3% year-on-year, and the tangible book value per share closed the year at €6.27, up 6.3%. In terms of the Group’s performance, measured in terms of return on equity (ROE) and return on total average assets (ROA), BBVA continues to be one of the most profitable banks in its reference group with a ROE of 15.8% and a ROA of 0.89%.