There were two crucial moments in 2010 in relation to sovereign debt in euro zone countries. The rescue of Greece in May and Ireland’s bailout in November. Both were accompanied by strong tensions in Spain’s country risk and increases in the spread of its debt against Germany’s. In May, this spread reached 200 basis points for 10-year maturities, while in November and December it peaked at 300 basis points. This situation gave rise to tensions on both monetary and long-term wholesale markets, penalizing institutions based on the geographical diversification of their business. The credit spreads applied, both in the primary market (issuance) and in the secondary and derivatives markets (credit default swaps, CDS), reached new all-time highs, exceeding those observed in 2009.

In this context, liquidity management by BBVA has been particularly proactive, through increasing the most stable retail liabilities and issuing in wholesale markets. There have been senior debt or coverage bond issues, backed by mortgage or public sector loans, during each four-month period of the year.

Although the spread applied has been increasing throughout the year, the issues have been well-received (always below the CDS level). In total, €16,919m were issued in 2010, in addition to the capital increase carried out in November.

In all cases, the Bank has financed itself, in accordance with its rating and capacity to generate recurrent results. It has never had to resort to public support or guarantees. Liquidity risk control in 2010 was, again, backed up by the maintenance of a sufficiently large buffer of liquid assets, fully available for discount, to cover the main short-term commitments. The Bank has thus acted ahead of the Basel Committee, which approved the creation of the LCR (liquidity coverage ratio) in October for implementation beginning in 2011.

The issuance policy in 2010 has been selective and aimed at ensuring diversified financing in a market context which is particularly difficult for the Spanish institutions. To prepare its medium-term strategy, the Group now has a new “Liquidity and Financing Manual”, which sets among its general principles decentralized management, self-financing of the investment activity by business area, and long-term management, in order to preserve solvency, growth sustainability, and recurrent earnings. This will enable the Bank to address the NSFR (net stable funding ratio) that Basel intends to implement beginning in 2018.

The Finance Division, through Asset/Liability Management manages structural financing and liquidity at BBVA, according to the policies and limits set by the Executive Committee at the proposal of the Risk area, which independently carries out measurement and control in each country according to a corporate scheme that includes stress analysis and contingency plans.

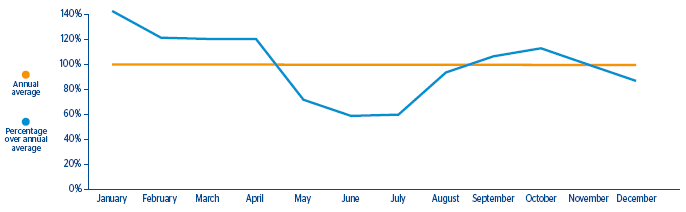

Chart 37 shows the relative annual trend of the main indicator used in 2010, basic liquidity, which was redefined in September as basic capacity, for monitoring the liquidity position and its potential risk.