With the acquisition of a holding in Garanti, BBVA has taken a very important step in the process of creating a diverse and balanced mix of businesses and geographical areas, with a high growth potential.

BBVA has become stronger after the agreement to acquire a 24.9% stake in Garanti, the leading bank in Turkey. This deal grants it access to what is a very attractive market:

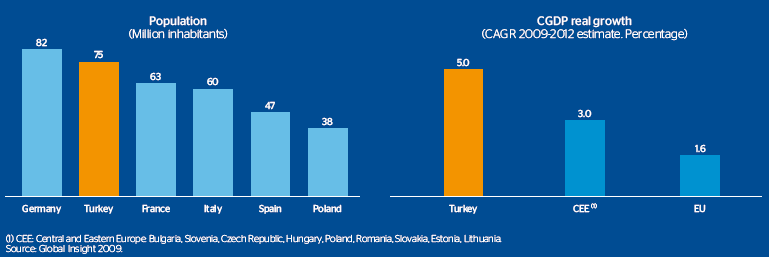

- With a high economic growth. The consensus of forecasts points to a real average increase in the country’s GDP

- With one of the largest and youngest populations in Europe: 75 million people, of whom 50% are under 30 years of age.

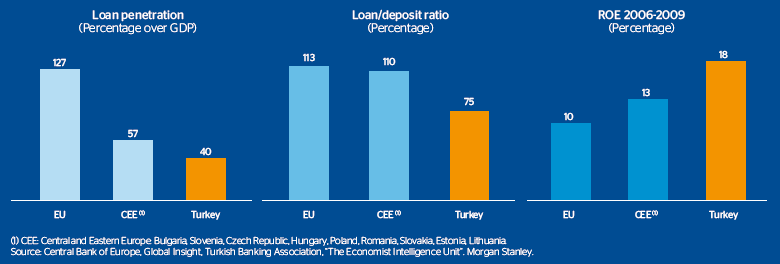

- It has a sound financial system with a potential for development. Turkey has the most attractive financial system in Europe, with among the lowest lending penetration rates, a good financial situation and high recurrent profits.

Garanti is also an excellent franchise with a highclass management team:

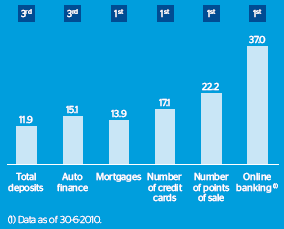

- Garanti is one of the best banking franchises in Turkey and enjoys a leading position in the main product lines. It has 9.5 million customers, a network of 863 branches and total assets of over €60,000m. It is the leading lending bank in the country and the third in share of deposits. It is also the leading issuer of credit cards.

- It has an international-class management team and an excellent brand image among Turkish banks. Garanti has been named the Best Bank in Turkey by Euromoney for the tenth time.

- Garanti shares BBVA’s focus, form of banking and firm commitment to technology and innovation. The bank has the best technological platform in Turkey, which puts it in a leading position in terms of online banking.

- The deal includes an option for a controlling stake, with an unbeatable partner (the Dogus Group), and in which the timing depends on BBVA. In short, the deal is excellent for BBVA.

BBVA’s financial soundness has enabled it to continue strengthening its investments in the CITIC Group, one of the main industrial conglomerates in China. Specifically, on April 1, 2010, it exercised its purchase option on an additional 4.93% of the share capital of China Citic Bank (CNCB), raising its holding to 15%. This confirmed the Bank’s strategic commitment to the Asian region, with revenues almost double over the year. BBVA is also working with CNCB on private banking business, auto finance, corporate banking, mergers and acquisitions, trade finance, market trading and pensions.

BBVA continues to strengthen its expansion in China and Latin America.

In Latin America, BBVA is strengthening its franchises, which closed in 2010 with business buoyant and overall increases in market share, and with ambitious organic growth plans. It is also worth noting that BBVA has built up its operations in Uruguay with the purchase of Crédit Uruguay Banco (CUB). The deal makes it the second largest private financial institution in the country, with a volume of assets of almost €1,900m, and customer funds of over €1,500m. The integration of CUB will begin when all of the authorizations have been received from the regulatory authorities. This process is expected to be complete in the first half of 2011.