(Consolidated figures)

| 31-12-10 | D% | 31-12-09 | 31-12-08 | |

|---|---|---|---|---|

| BALANCE SHEET (million euros) | ||||

| Total assets | 552,738 | 3.3 | 535,065 | 542,650 |

| Total lending (gross) | 348,253 | 4.8 | 332,162 | 342,682 |

| Customer funds on balance sheet | 378,388 | 1.7 | 371,999 | 376,380 |

| Other customer funds | 147,572 | 7.6 | 137,105 | 119,028 |

| Total customer funds | 525,960 | 3.3 | 509,104 | 495,408 |

| Total equity | 37,475 | 21.8 | 30,763 | 26,705 |

| Stockholders' funds | 36,689 | 25.0 | 29,362 | 26,586 |

| INCOME STATEMENT (million euros) | ||||

| Net interest income | 13,320 | (4.0) | 13,882 | 11,686 |

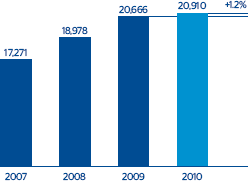

| Gross income | 20,910 | 1.2 | 20,666 | 18,978 |

| Operating income | 11,942 | (3.0) | 12,308 | 10,523 |

| Income before tax | 6,422 | 12.0 | 5,736 | 6,926 |

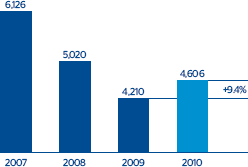

| Net attributable profit | 4,606 | 9.4 | 4,210 | 5,020 |

| Net attributable profit excluding one-offs (1) | 4,606 | (12.4) | 5,260 | 5,414 |

| DATA PER SHARE AND SHARE PERFORMANCE RATIOS | ||||

| Share price (euros) | 7.56 | (40.6) | 12.73 | 8.66 |

| Market capitalization (million euros) | 33,951 | (28.8) | 47,712 | 32,457 |

| Net attributable profit per share (euros) (2) | 1.17 | 8.3 | 1.08 | 1.31 |

| Net attributable profit per share excluding one-offs (euros) (1 - 2) | 1.17 | (13.3) | 1.35 | 1.41 |

| Dividend per share (euros) (3) | 0.42 | - | 0.42 | 0.63 |

| Book value per share (euros) | 8.17 | 4.3 | 7.83 | 7.09 |

| Tangible book value per share (euros) (4) | 6.27 | 6.3 | 5.90 | 4.99 |

| P/BV (Price/book value; times) | 0.9 |

|

1.6 | 1.2 |

| Price/tangible book value (times) (4) | 1.2 |

|

2.2 | 1.7 |

| PER (Price/Earnings; times) | 7.4 |

|

11.3 | 6.5 |

| Yield (Dividend/Price; %) (3) | 5.6 |

|

3.3 | 7.3 |

| SIGNIFICANT RATIOS (%) | ||||

| ROE (Net attributable profit/Average equity) | 15.8 |

|

16.0 | 21.5 |

| ROE excluding one-offs (1) | 15.8 |

|

20.0 | 23.2 |

| ROA (Net income/Average total assets) | 0.89 |

|

0.85 | 1.04 |

| ROA excluding one-offs (1) | 0.89 |

|

1.04 | 1.12 |

| RORWA (Net income/Average risk-weighted assets) | 1.64 |

|

1.56 | 1.94 |

| RORWA excluding one-offs (1) | 1.64 |

|

1.92 | 2.08 |

| Efficiency ratio | 42.9 |

|

40.4 | 44.6 |

| Risk premium | 1.33 |

|

1.54 | 0.83 |

| NPA ratio | 4.1 |

|

4.3 | 2.3 |

| NPA coverage ratio | 62 |

|

57 | 92 |

| CAPITAL ADEQUACY RATIOS (%) | ||||

| BIS Ratio | 13.7 |

|

13.6 | 12.2 |

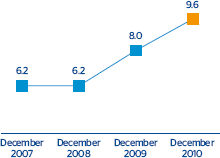

| Core capital | 9.6 |

|

8.0 | 6.2 |

| Tier I | 10.5 |

|

9.4 | 7.9 |

| OTHER INFORMATION | ||||

| Number of shares (millions) | 4,491 |

|

3,748 | 3,748 |

| Number of shareholders | 952,618 |

|

884,373 | 903,897 |

| Number of employees | 106,976 |

|

103,721 | 108,972 |

| Number of branches | 7,361 |

|

7,466 | 7,787 |

| Number of ATMs | 16,995 |

|

15,716 | 14,888 |