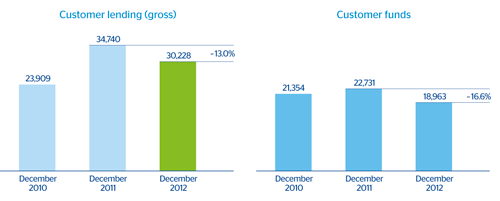

This area managed gross customer lending of €30,228m at the close of 2012, down 13.0% year-on-year. The fall is a result of the reduction in the loan portfolio of wholesale customers due to the deleveraging process underway in Europe. In contrast, lending activity in the retail business performed well. The volume of residential mortgage lending, consumer finance and loans to small businesses has risen over the last 12 months by 11.3%. There was a notable contribution from the balances in Turkey, which account for 36.8% of gross customer lending in the area. They increased by 15.1% on the figure at the same date the previous year.

The balance of customer funds (including repos and off-balance-sheet funds) as of 31-Dec-2012 was €18,963m, a year-on-year fall of 16.6%. However, over the last three months the decline was barely 2.0%. The recovery in deposits in the wholesale sector in the fourth quarter explains this improvement toward the end of the year, after being very weak in the first nine months due to the downgrades in Spain and BBVA’s credit ratings.

15 Eurasia. Key activity data

(Million euros)

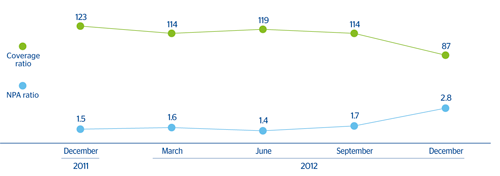

With respect to risk indicators, there was a slight increase in the NPA ratio, which closed as of 31-Dec-2012 at 2.8%. However, the ratio continues low, mainly due to the lower volume of lending. The coverage ratio ended the year at 87% and the risk premium at 0.97%.

16 Eurasia. NPA and coverage ratios

(Percentage)