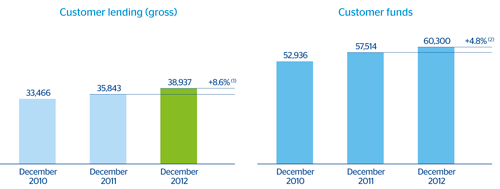

As of the close of the year, gross customer lending in Mexico was up year-on-year by 8.6% to €38,937m. Customer funds (on-balance sheet deposits, repos, mutual funds and other off-balance funds) closed the year up 4.8% year-on-year to €60,300m.

27 Mexico. Key activity data

(Million euros at constant exchange rate)

(2) At current exchange rate: +10.1%.

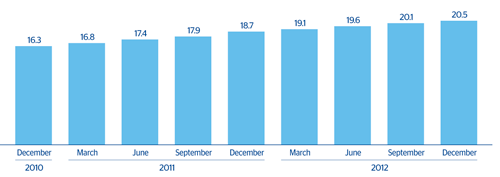

The retail portfolio, which includes consumer finance, credit cards, residential mortgages and loans to small businesses, performed very well, with a balance of €20,481m, equivalent to an increase of 9.6% compared with the figure for the close of 2011.

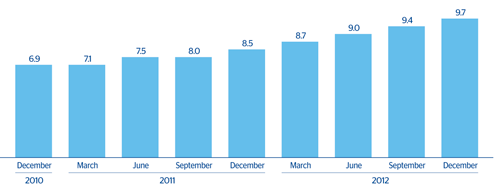

28 Mexico. Retail portfolio evolution

(Billion euros at constant exchange rate)

Outstanding within this portfolio was lending to small businesses, which increased 26.5% on the figure for 2011.

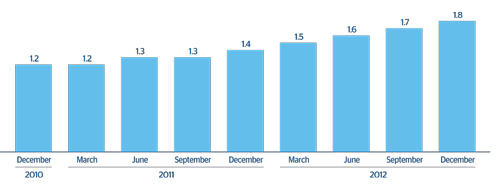

29 Mexico. Lending to small businesses evolution

(Billion euros at constant exchange rate)

Consumer finance and credit cards rose by 13.3% to €9,675m. It is worth highlighting that over a million consumer loans were sold during the year, including payroll, auto and personal loans. Credit card lending has continued to perform well, with a year-on-year increase of 14.1%.

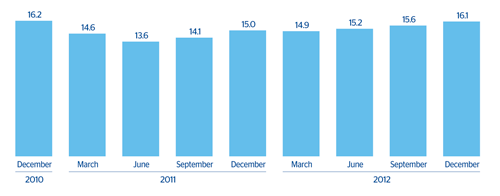

30 Mexico. Consumer finance plus credit cards evolution

(Billion euros at constant exchange rate)

Residential mortgages increased by 3.0% to €8,911m. Over 28,300 new mortgages were granted in 2012. This has maintained BBVA’s leadership in Mexico in the private sector, signing one out of three of new mortgages granted by banks and Sofoles.

The wholesale portfolio, which includes loans to corporations, SMEs, financial institutions and the public sector, is up 7.4% year-on-year to €16,084m. There was a particularly good performance in lending to SMEs, which has grown year-on-year at double-digit rates throughout the last twelve months, closing December at 12.2%. Loans to the public sector amounted to €3,590m. In 2012, lending to corporates through CIB continued to increase. This has been reflected in the bank’s active participation in corporate debt issues on capital markets, where BBVA has maintained its lead in Mexico, with a market share of 25.1% as of the close of December 2012, according to Dealogic.

31 Mexico. Wholesale portfolio evolution

(Billion euros at constant exchange rate)

In customer funds, demand deposits increased by 6.9%, with a notable performance by customer funds from the retail network, which increased by 7.3% compared with the close of 2011. BBVA continues to lead the demand deposit segment, with a third of the market, making it the favorite bank for savers in the country. Throughout the year, BBVA Group in Mexico has maintained its strategy of ensuring a profitable mix of liabilities, as reflected in the 7.9% year-on-year fall in time deposits. This fall has been offset by the increase in the assets under management in mutual funds (up 6.7%) and other more sophisticated products such as repos and other fixed-income products.

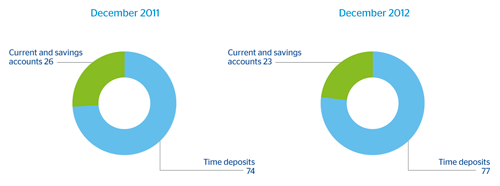

These figures mean that the mix of customer funds continues to maintain a profitable structure. A total of 77% of all deposit gathering was in low-cost deposits, while the remaining 23% was in time deposits.

32 Mexico. Structure of customer funds. Deposit gathering (1)

(Percentage)