BBVA customer experience, a lever for growth

BBVA is constantly researching and developing global strategies designed to improve the customer experience in all the geographical areas in which it operates, in all the products it offers and in all the sales and contact channels that it makes available to them.

Transversality plays a key role in all the objectives. Consequently, the best practices obtained in day-to-day experience with customers flow across and are present in each of the quality and customer experience models in the countries where the Group operates.

2012 has been a year in which the Group, in an environment of global crisis, has been able to adequately respond to customer demands. Clients have asked for superior quality in customer service, while requiring security for their savings and a strong capital position that makes BBVA trustworthy.

BBVA integrates customers in its core business in all the countries where it operates to ensure that their experience is as positive as possible, and that as a result they recommend the Bank to families and friends, thus making recommendations a lever for growth. To meet this challenge, BBVA has deployed a “Customer Experience” model across the whole Group, based on three pillars:

- In-depth customer knowledge and experience assessment in each contact, service and product.

- Implementation of plans to improve and guarantee the best service possible and thus an outstanding experience.

- An appropriate attitude and commitment on the part of all the BBVA team.

Customer insight

BBVA has a global architecture in place for measuring quality and customer experience, leveraged on the Net Promoter Score methodology

In each country and business where it operates, BBVA also has a broad range of tools for consultation and dialog with stakeholders, as mentioned above. To give it insight into its customers, BBVA has a global architecture in place to measure quality and customer experience. Leveraged on the Net Promoter Score (NPS) methodology, it allows to collect ongoing information on customer experience with the products, services and contact with the Bank’s staff.

The NPS program provides the degree to which customers recommend BBVA (they are classified as promoters, passive customers and detractors), an understanding of the factors influencing the decision to recommend, and an overview of BBVA’s position in the industry.

Apart from using it as a metric, BBVA applies this methodology as a management model to generate specific action plans designed to build and maintain customer loyalty, involving the whole Organization in this purpose.

As a supplement to the NPS system, each entity in the Group carries out regular customer satisfaction surveys and additional studies that reflect customer expectations regarding the products and the perception of BBVA’s service quality.

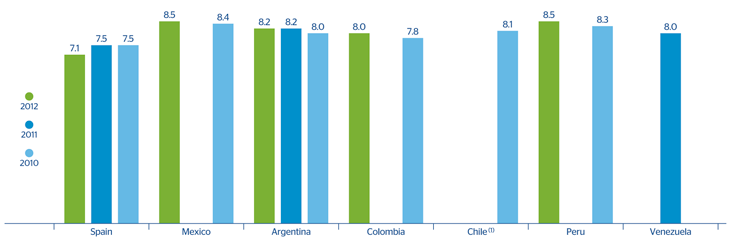

10 Customer satisfaction indicators

(Scale 1 to 10)

Dates according to the scope of consolidation at the close of each year.

(1) The study planned for 2012 has been postponed until the following year. Source: FRS Inmark, except in the case of Argentina, carried out by Knack.

Quality plans

Quality, the key element to improving customer experience

The goal of the Group’s customer strategy is based on considering quality a key element for transforming the Organization. It requires prior identification of the main areas for improvement or opportunities of a general nature, based on customer insight. BBVA develops a number of quality plans designed to improve the customer experience.

Spain: a unique experience

For the last decade, BBVA branch network has, year after year, carried out its activity based on quality plans designed to ensure that customers receive a better service. During this time, BBVA has adapted quality plans to the changing economic environment, while always seeking to meet customers’ needs.

In 2012, with the opportunity offered by the in-depth knowledge the branches have gained of their customers, BBVA launched CalidadX3. Since its launch in May 2012, all the branches, managers and BBVA head office have been involved in a dynamic program focused on attitude and commitment, using advanced tools to:

- Promote the customer care model, attitude and commitment to customers.

- Offer customers the best service and the best management of their financial needs.

- Promote and guarantee transparent and personalized communication with each customer at all times.

- Develop schemes that encourage and create incentives for managers to offer a special customer experience in each branch backed by the BBVA guarantee.

South America: standardized model for a region that is clearly growing

In 2012, a common system at regional level has been developed, based on four core elements:

- Implement the NPS corporate architecture in all the businesses, with continuous systematic measurement to check customer experience and identify the results of the improvements implemented at the process and customer care level.

- Design/review experiences that are gratifying for the customer, developing and implementing customer care protocols in the branch networks, particularly at key moments such as the arrival of a new customer or claims management.

- Improve quality performance in the network, including customer referral in the system of incentives, and carrying out priority monitoring of quality indicators.

- Boost the culture of quality and customer experience, based on the definition of what service and customer commitment means, by developing a training plan for quality in customer service skills and implementing tools aimed at identifying quality actions.

With respect to the last point, in 2012 progress was made in the deployment of the “Quality Culture Model for South America”. Focused on the value proposition, role modeling, tools and training, this model has a twofold objective: First, to make the head office aware of customer needs, and second, to provide the branch network with appropriate and sufficient resources to manage quality.

Mexico: improve customer experience at the points of contact

The quality strategy in this area for 2012 and 2013 is focused on improving the customer experience at any of the points of contact they choose and/or use: Bancomer.com, Línea Bancomer, the branch network, ATMs, “practicajas”, kiosks, etc. The following lines are taken into account:

- Flexibility and speed.

- Friendliness and service attitude.

- Infrastructure.

In 2012, BBVA worked on the following in Mexico: training, through e-learning courses dealing with quality and service; implementation of the “Sucursales Limpias” (Clean branches) program; distribution of quality materials and tools; and introduction of the “router” position, etc.

In 2013, the Quality Plan in this area aims to boost a change in service culture in order to improve customer satisfaction. It will include behavior such as: friendliness, correct advice to customer, consistency, empathy and quick service.

Service models have been generated to comply with the above, and they will be implemented in the branch network. At the same time, we are working in cutting waiting time. Pilot schemes for ticket dispenser queuing systems have been carried out, and they are planned to be expanded to 430 branches. This will give customers the new experience of announcing their arrival through an electronic touchscreen that prints the ticket on entry to the branch and offers a variety of possible services (cash desks segmented according to customer needs).

Other targets for 2013 are: to reduce the number of complaints, bring the resolution mechanism closer to the point of contact and reduce response times; bring the Línea Bancomer service model in line with that of the bank; provide correct advice on any subject; standardize the customer service and care protocols in insurance; readdressing certain clients to other segments; and, as part of customer insight, rethink the existing indicators according to a more customer-based vision.

BBVA commitment

BBVA employees are the brand voice and the creators of BBVA experience in their daily interactions with customers. That is why they are undoubtedly the key to the success of our differentiation.

All the Group’s workers have to be involved to offer customers the best possible experience, regardless of whether they are in direct contact with customers or not. Based on this premise, BBVA has created a customer-oriented incentive system that assesses employee contribution to customer satisfaction.

In line with the NPS methodology, the incentive systems of the business units have been reviewed in 2012 to take recommendations into account.

Complaints management

BBVA is committed to a complaints management model aimed at serving customers flexibly, efficiently and through their channel of choice

In recent years, clear and determined progress has been made in all the countries where BBVA operates toward a model of centralized claims management, based on swift personalized response, taking into account the circumstances of each individual customer.

In a distribution model such as that of BBVA, which is committed to multi-channel operations, the consolidation of the incident resolution scheme at first contact has been key, but some local models are going even further and manage claims by trying to provide a superior experience to their customers.

At BBVA, claims are considered an opportunity for continuous improvement of customer experience in their relations with the Bank. As a claim is a critical moment, an immediate resolution generates greater customer satisfaction and demonstrates the Bank’s know-how; at the same time, an analysis of the incident will provide a diagnosis and action plan to root out the cause of the problem.

As a result of the efforts made, in 2012 BBVA customers have shown themselves more satisfied with the service they have received.

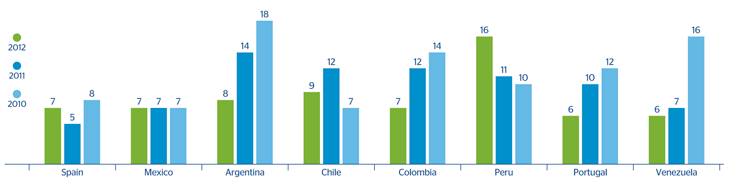

11 Average incident resolution time

(Number of days)

Number of claims filed at the Banking Supervisory Authority for each 1 billion euros of activity (1)

Download Excel

Download Excel

|

|

2012 | 2011 | 2010 |

|---|---|---|---|

| BBVA Spain | 3 | 2 | 3 |

| BBVA Bancomer (Mexico) | 302 | 421 | 425 |

| BBVA Francés (Argentina) | 96 | 91 | 100 |

| BBVA Continental (Peru) | 39 | 31 | 27 |

| BBVA Colombia | 114 | 207 | 231 |

| BBVA Chile | 19 | 30 | 26 |

| BBVA Portugal | 15 | 11 | 5 |

| BBVA Provincial (Venezuela) | 60 | 74 | 209 |