The extent of the crisis has led the authorities to implement a broad-based regulatory reform

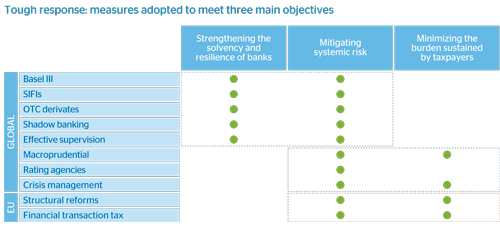

Since 2008 the international financial system has been hit by a regulatory tsunami. The extent of the crisis has led international authorities to adopt a tough and firm response to avoid past errors. Three major economic policy objectives can be identified in the measures adopted for global regulatory reform:

- Strengthening the solvency and resilience of banks.

- Mitigating systemic risk.

- Minimizing the burden sustained by taxpayers.

16 Objectives of the regulatory reform

Once the measures have been adopted and the technical outlines and design of the regulations are approaching conclusion, the authorities of the countries involved immersed in their practical implementation. The Financial Stability Board monitors the situation to ensure the measures are being implemented appropriately in each of the jurisdictions. The banks will have to make internal changes to adapt to the regulatory reform. This could lead to a new banking system defined by the following parameters:

- A stronger risk culture.

- A return to the core banking activity and social function.

- Stronger corporate governance.

- Business structures and models with simpler resolution plans.