At the close of 2012, BBVA’s balance sheet and activity were characterized by:

- A year-on-year increase of 1.7% in gross customer lending. Growth in activity in emerging markets and the incorporation of Unnim have offset lower lending in Spain and in CIB loan portfolios in developed countries.

- Positive performance in on-balance-sheet customer funds due mainly to the performance of the retail segment.

- Growth of debt certificates, basically due to new issues and promissory notes placed in the retail network.

- Positive impact of exchange rates.

Consolidated balance sheet

(Million euros)

Download Excel

Download Excel

|

|

31-12-12 | Δ% | 31-12-11 | 31-12-10 |

|---|---|---|---|---|

| Cash and balances with central banks | 37,434 | 21.0 | 30,939 | 19,981 |

| Financial assets held for trading | 79,954 | 13.2 | 70,602 | 63,283 |

| Other financial assets designated at fair value through profit or loss | 2,853 | (4.2) | 2,977 | 2,774 |

| Available-for-sale financial assets | 71,500 | 23.0 | 58,144 | 56,456 |

| Loans and receivables | 383,410 | 0.6 | 381,076 | 364,707 |

| Loans and advances to credit institutions | 26,522 | 1.6 | 26,107 | 23,637 |

| Loans and advances to customers | 352,931 | 0.3 | 351,900 | 338,857 |

| Other | 3,957 | 28.9 | 3,069 | 2,213 |

| Held-to-maturity investments | 10,162 | (7.2) | 10,955 | 9,946 |

| Investments in entities accounted for using the equity method | 6,795 | 16.3 | 5,843 | 4,547 |

| Tangible assets | 7,785 | 6.2 | 7,330 | 6,701 |

| Intangible assets | 8,912 | 2.7 | 8,677 | 8,007 |

| Other assets | 28,980 | 37.1 | 21,145 | 16,336 |

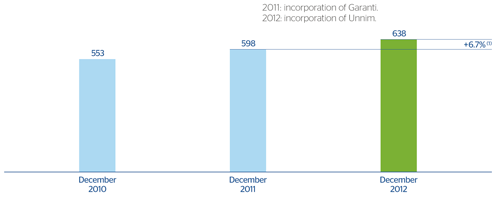

| Total assets | 637,785 | 6.7 | 597,688 | 552,738 |

| Financial liabilities held for trading | 55,927 | 9.0 | 51,303 | 37,212 |

| Other financial liabilities at fair value through profit or loss | 2,516 | 37.9 | 1,825 | 1,607 |

| Financial liabilities at amortized cost | 506,487 | 5.5 | 479,904 | 453,164 |

| Deposits from central banks and credit institutions | 106,511 | 15.1 | 92,503 | 68,180 |

| Deposits from customers | 292,716 | 3.7 | 282,173 | 275,789 |

| Debt certificates | 87,212 | 6.4 | 81,930 | 85,179 |

| Subordinated liabilities | 11,831 | (23.3) | 15,419 | 17,420 |

| Other financial liabilities | 8,216 | 4.3 | 7,879 | 6,596 |

| Liabilities under insurance contracts | 9,032 | 16.7 | 7,737 | 8,034 |

| Other liabilities | 20,021 | 18.7 | 16,861 | 15,246 |

| Total liabilities | 593,983 | 6.5 | 557,630 | 515,263 |

| Non-controlling interests | 2,372 | 25.3 | 1,893 | 1,556 |

| Valuation adjustments | (2,184) | (21.6) | (2,787) | (770) |

| Shareholders' funds | 43,614 | 6.5 | 40,952 | 36,689 |

| Total equity | 43,802 | 9.3 | 40,058 | 37,475 |

| Total equity and liabilities | 637,785 | 6.7 | 597,688 | 552,738 |

| Memorandum item: |

|

|

|

|

| Contingent liabilities | 39,540 | (0.9) | 39,904 | 36,441 |

In short, a year in which there has been improvement in the Group’s liquidity and funding structure.

18 BBVA Group. Total assets

(Billion euros)