The achievement of banking and fiscal union in Europe will be decisive for giving greater credibility to the European project

Turning now to the banking sector, for Europe 2012 has been a year of great financial tensions, as mentioned before. These tensions meant that the positive effect on risk premiums of the ECB’s liquidity injections have virtually disappeared.

In the second half of the year, it was again the ECB which took a decisive step to bring the debt crisis in Europe to an end by announcing a new program to buy sovereign public debt. Following the Eurogroup summit in late June, Europe has been working on designing a roadmap toward banking and fiscal union, conditions which are considered to be necessary to make the European project credible.

In Spain, significant progress has been made in restructuring the financial system, with the implementation of major reforms, while evidencing the diverse nature of the Spanish banking sector. Some of the most important achievements are as follows:

In Spain, there has been significant progress on the restructuring of the financial system

- Enactment of the two Royal Decre-Laws in February and May designed to provision for the risk of real-estate assets (problematic and non-problematic).

- Granting by the European authorities of a loan of up to €100,000m to bolster the solvency of the Spanish financial system.

- Approval of Royal Decree-Law (and subsequent Act) for the Restructuring and Resolution of Credit Institutions, which is an essential tool for managing crises in financial institutions. This is a major step forward in reforming the system, given that it reinforces the instruments, the role of public institutions and the procedures for the restructuring and resolution of financial institutions.

- Publication of the results of the stress tests carried out on Spanish banks by two independent international consultants (top-down tests). The stress tests identified capital requirements of between €51,000m and €62,000m. Then the results of the stress tests on the same 14 Spanish banking groups carried out using individual analysis of each institution were published (bottom-up tests). The results revealed capital requirements of €54,000m limited to institutions which account for around 30% of the system’s assets, and concentrated in those controlled by the Orderly Bank Restructuring Fund (FROB).

- Creation of the Asset Management Company for Assets Arising from Bank Restructuring (SAREB), controlled by the FROB with a minority stake. The SAREB will be responsible for managing assets linked to the real-estate sector transferred to it by nationalized banks and those requiring public funds.

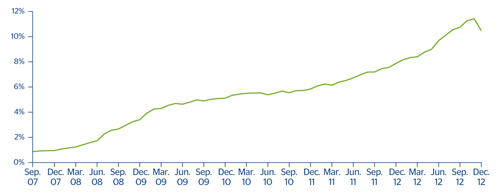

In the midst of all these achievements, the financial industry has continued with its deleveraging process, leading to a reduction in business volume and a negative impact on the NPA ratio of the sector, which at the end of December amounted to 10.4% for the system as a whole.

14 NPA ratio of the Spanish private sector (1)

(Percentage)

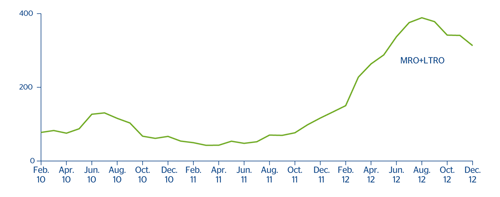

The easing of financial tensions in the closing months of 2012 has prompted a reduction of the funds requested from the ECB to €313,109m in December, after a high of €388,736m in August.

15 ECB net funding for Spanish credit institutions

(Billion euros)

The health of the banking system continues to improve in the United States

In the United States, the banking system continues to recover, and there are now fewer institutions facing problems. The NPA ratio of commercial banks has decreased over the course of 2012 in all segments, although it flared up slightly in the residential real-estate segment in the third quarter. Lending conditions are likely to remain strict in 2013, particularly for residential loans, in light of the high financial burden of households.

In Mexico, the financial system is in an enviable situation, with a capital ratio far above the required minimum of 10%. As a result, it will be one of the first countries to adopt the Basel III accords. Lending is growing strongly, and has reported 20 successive months of double-digit year-on-year growth. Growth is evident in all components of bank lending, and this dynamic mood is expected to continue due to the favorable macroeconomic environment. Growth has slowed in traditional customer funds, due to the less dynamic role played by time deposits in the light of the strong growth in investment companies (SID, non-banking savings instruments which are a substitute for time deposits). However, there are no liquidity tensions.

In Latin America, the sector remains very sound

In South America, the financial system in most countries remains sound and there is strong growth in lending, fueled by monetary policies geared towards boosting economic activity. Faced with external monetary expansion and the ensuing increase in capital flows, many central banks have chosen to apply macroprudential measures to discourage capital inflows and to control the rise in domestic lending (particularly in Brazil and Peru).

In Turkey there has been a notable growth in credit while NPA ratios have remained low. Reforms continue in China

In Turkey, lending to the private sector has risen considerably (+16.0 year to year), although the percentages are lower than the figures of 2011. This is, mainly, due to the increase in the official interest rates in the second half of the year (for the first time in over a year). Finally, the NPA ratio remains at low levels.

Lastly, in China, the authorities have launched several reforms since the start of the year, including measures designed to liberalize interest rates and provide greater flexibility in exchange rates. In June and July, the Central Bank broadened the range of discounts permitted in interest rates for loans to 30%, and introduced a 10% premium on the benchmark interest rate for deposits. It also reduced the reserve requirement by 150 basis points. In September, the financial sector plan was published, following on from the Five-Year Plan (2011-2015), restating the intention of abolishing interest rate controls, opening the capital account, promoting financial innovation and reinforcing the financial regulation framework. The Plan also sets quantitative targets for the added value of the financial sector (up to 5.0% of GDP in 2015, compared with 4.4% in the last decade). In this context, growth in bank lending remains relatively stable, although the proportion of long-term loans has increased, showing that credit flows are being drawn to public infrastructure projects and business investments.