Selective growth of lending and improvement in mix activity

BBVA Compass business activity

(Year-on-year rate as at 31-12-12)

45 Net interest income(Million euros at constant |

Gross income(Million euros at constant |

Operating income(Million euros at constant |

|---|

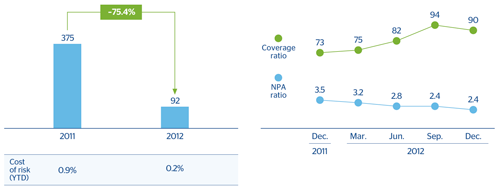

Positive evolution of the asset quality

46 Loan-loss provisions(Million euros at constant exchange rate) |

NPA and coverage ratios(Percentage) |

|---|

In short, a business transformation reflected in the area’s profit

47 Net attributable profit

(Million euros at constant exchange rate)

Income statement

(Million euros at constant exchange rate)

|

|

Accumulated | Year-on-year change 2012-2011 | |

|---|---|---|---|

|

|

2012 | Absolute | Percentage |

| Net interest income | 1,682 | – 82 | –4.7 |

| Gross income | 2,395 | – 104 | –4.2 |

| Operating income | 812 | – 76 | –8.6 |

| Income before tax | 667 | +1,779 | n.s. |

| Net attributable profit | 475 | +1,229 | n.s. |