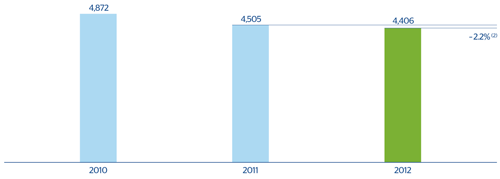

The Group’s net attributable profit stood at €1,676m. Excluding the charge for impairment of the assets related to the real-estate sector in Spain and the badwill generated by the Unnim operation, the adjusted net attributable profit amounts to €4,406m (€4,505m in 2011, after also deducting the charge for goodwill impairment in the United States). To sum up, the BBVA Group continues to generate sound earnings despite the difficult environment.

15 BBVA Group. Net attributable profit (1)

(Million euros)

(2) At constant exchange rates: -5.2%

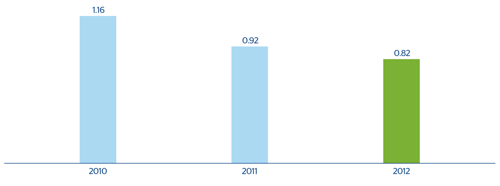

16 BBVA Group. Earnings per share (1)

(Euros)

By business areas, Spain posted a €1,267m loss. Excluding the charge for the impairment of real-estate assets, the area generated adjusted earnings of €1,211m. Eurasia contributed €950m, Mexico €1,821m, South America €1,347m and the United States €475m.

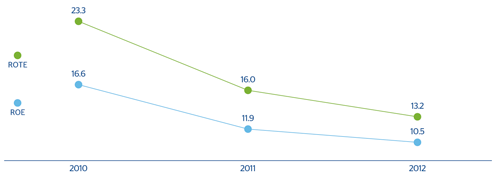

Lastly, earnings per share (EPS) from January to December 2012 stood at €0.32 (€0.82 in terms of adjusted EPS); return on equity (ROE), 4.0% (10.5% adjusted); and return on tangible equity excluding goodwill (ROTE), 5.0% (13.2% adjusted).

17 BBVA Group. ROE (1) and ROTE (1)