2012 was a year in which investment in Mexico continued to take advantage of market opportunities in order to maintain a sound financial position.

Net interest income in the area amounted to €4,164m, 7.8% up on 2011. The activity volume, combined with good price management, have offset the impact of low interest rates throughout the year. As a result, despite the interest-rate environment mentioned above, profitability, calculated as the net interest income over average total assets, showed a stable trend.

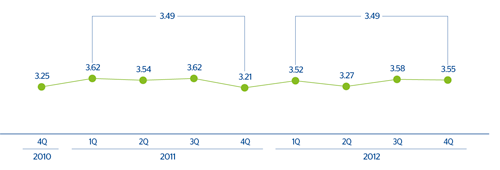

33 Mexico. Net interest income over ATA

(Percentage)

Income from fees and commissions increased by 4.0% to €1,087m, due to increased transactions by customers with credit and debit cards, and a higher volume of assets under management in mutual funds. In contrast, NTI registered a fall because of the comparison with the high level of income in 2011. The trend in other income and expenses continued to be positive, thanks above all to the favorable performance of the insurance business. As a result of the above, gross income was €5,758m, 5.8% up on the figure for 2011.

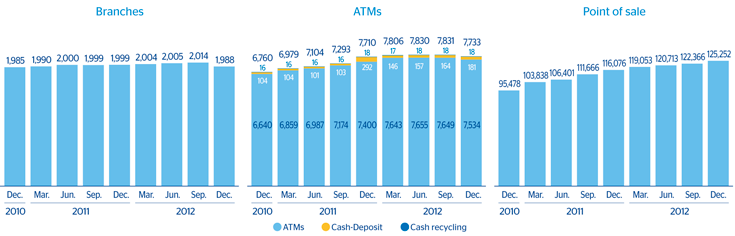

The increase of operating expenses is the result of the investment in technology and infrastructure over recent years. Because of this, operating expenses in 2012 were up 9.7% to €2,172m. The number of ATMs continued to grow over the year to 7,733 units, while POS terminals increased by 9,176 units over the last twelve months. With these figures for revenue and costs, the efficiency ratio remains one of the best in the Mexican system, at 37.7% as of the close of 2012. Operating income totaled €3,586m, 3.6% up on the figure for 2011. Excluding the most volatile revenues from NTI, operating income increased over the year by 6.6%.

34 Mexico. Distribution network evolution

(Branches, ATMs and points of sale)

35 Mexico. Efficiency

36 BBVA Bancomer and Mexican banking system efficiency (1)

(Percentage)

Source: CNBV. Data from banks without subsidiaries.

(2) Data collected under local accounting principles.

37 Mexico. Operating income and operating income net of NTI

(Million euros at constant exchange rate)

(2) At current exchange rate: +9.0%.

Impairment losses on financial assets increased in line with activity in the area, at 9.4% year-on-year to €1,320m. As a result, the cumulative risk premium has been stable on the figure for last year, at 3.49%. The NPA ratio closed at 3.8% as of 31-Dec-2012, and the coverage ratio at 114%.

38 Mexico. Risk premium

(Percentage)

39 Mexico. NPA and coverage ratios

(Percentage)

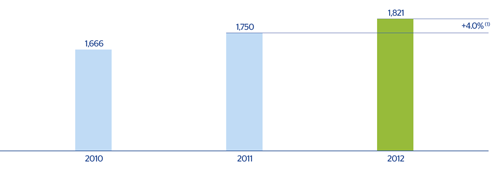

As a result of the above, the net attributable profit increased by 4.0% on the 2011 figure to €1,821m.

40 Mexico. Net attributable profit

(Million euros at constant exchange rate)

(1) At current exchange rate: +6.4%

Below are some of the most important aspects of the performance of the various business units in 2012.