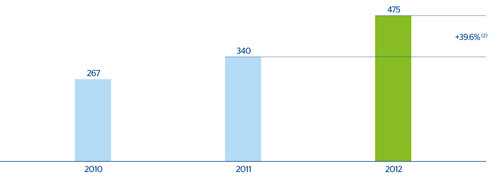

The United States ended the year with a net attributable profit of €475m, well above the previous year, when it totaled €320m, excluding the goodwill impairment. Thus, the area’s earnings grew 39.6% compared with 2011, if the aforementioned goodwill impairment is excluded. This improvement is related to enhanced asset quality, and containment of operating costs.

54 The United States. Net attributable profit (1)

(Million euros at constant exchange rate)

(2) At current exchange rate: +48.4%.

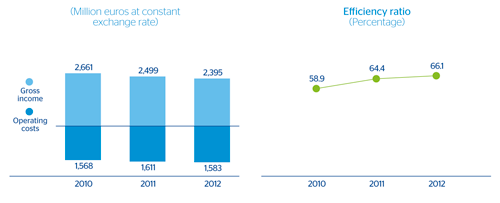

Gross income in the area amounted to €2,395m in 2012, a year-on-year decline of 4.2%. The low interest rate environment and flat curves, together with the run-off of the Guaranty portfolio, affected the net interest income, which was down 4.7% in the same period. The reduction of interest bearing deposits and lending activity increase that did not offset the negative figures mentioned above. Regulatory pressures also had a negative impact on income from fees, which fell by 11.1%. BBVA Compass has implemented a number of measures designed to mitigate the adverse effects of the new regulatory environment (Durbin). An example of this is the increase in fees and commissions from the new residential real-estate loans.

55 BBVA Compass. Customer spread

(Percentage)

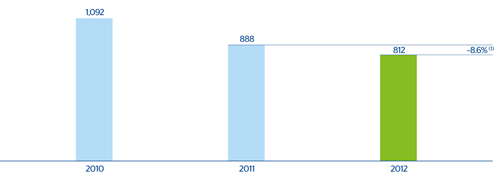

The area was able to successfully manage operating expenses which declined by 1.7% year-on-year. This improvement is largely attributable to the streamlining of operating expenses due to the implementation of the technological platform in all BBVA Compass branches. As a consequence, operating income amounted to €812m, 8.6% down on 2011.

56 The United States. Efficiency

57 The United States. Operating income

(Million euros at constant exchange rate)

Impairment losses on financial assets fell by 75.9% year-on-year to €90m.

Finally, the capital ratios of BBVA Compass remained solid, according to local criteria: a Tier I Ratio of 11.7% and a Tier 1 Common of 11.4%.

Below are some of the most important aspects of the performance of the various BBVA Compass business units in 2012.

Commercial Banking

This unit, which manages SMEs, has once again posted year-on-year growth in loans and deposits. Commercial Banking has recently accessed new sectors, while expanding its presence in those where it was already active. A food franchise segment has been set up to meet the credit, cash management and capital market needs of the owners of restaurant franchises in the United States. In addition, equipment finance and leasing activities began in the fourth quarter of 2012, which will be focused primarily on companies with sales in excess of USD 100m. This new activity will boost and support the planned access to other segments, such as transportation, agribusiness and healthcare. The business is currently in its initial stages and is expected to begin its production activity by the end of the second quarter of 2013.

Corporate Banking

This unit, which specializes in large corporations, has increased the size of its loan portfolio by more than 40% over the last twelve months. Corporate Banking is planning to expand its presence in various activities and businesses, such as foreign exchange, derivatives and commercial credit card products, in order to create a more robust market segment and a more comprehensive range of products with greater added value for customers, as well as starting to attract international customers.

Retail Banking

The Retail Banking division of BBVA Compass has seen its loan portfolio grow significantly in 2012 thanks to the increase in residential real-estate loans. Customer funds have also grown above all lower-cost items.

This area has played a key role in offering the most innovative and interactive technology to provide greater convenience to its customers. Nearly 6% of new customers have been attracted online, and this figure is expected to increase with the investments planned for the online channel.

Following the strategy to increase customer loyalty, the Retail Banking unit launched products and services that include price differentiation, financial advisory service, discounts on certain services, as well as units that are fully dedicated to customer service (more personalized and faster, and with extended hours).

Regarding liability products, BBVA Compass launched a campaign to attract money-market accounts in the second quarter of 2012, which has resulted in the opening of many accounts and an increase in customer deposits over the year. In addition, through the “Everyday Hero” program, customers who qualify, such as fire departments, police stations and hospitals, are offered build-to-order checking accounts with no monthly service charge.

Wealth Management

The lending growth of this division has benefited from the low rates environment. Demand deposits have also grown over the last twelve months. This increase is partially related to the new products launched in 2012, including a national structured note solution, an international integrated account product and several creative solutions aimed meeting customer needs. Wealth Management has started to expand its sales force and expects to treble the number of financial advisors by the end of 2013 in order to meet the needs of customers.