The banking model in BBVA

BBVA continues to perform well in a still difficult environment

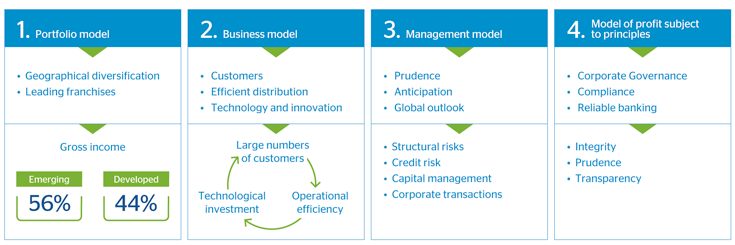

In the context described above, one more year the Group has continued to show its high capacity for generating recurrent earnings, as well as its great structural strength. This standout performance is due to BBVA’s unique approach to banking based on four pillars:

17 BBVA, a banking model based on four pillars

1. A portfolio model characterized by:

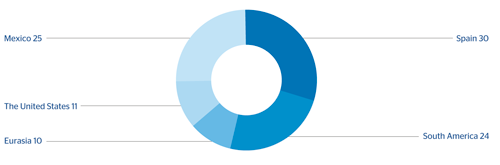

- A very balanced diversification in terms of geographical areas, businesses and segments, which is essential for ensuring resilience in any environment. This diversification has continued to be important in 2012. It has ensured the maintenance of a high level of recurrent earnings, as well as meeting the high loan-loss provision requirements in Spain. In this regard, 56% of gross income originated in emerging countries.

18 Gross income breakdown by geographical area (1)

(Percentage)

- Franchises with a sufficiently large customer base, holding leading positions in all the markets (1st/2nd in Spain, market leader in Mexico, 1st/2nd in South America, leadership position in the US Sunbelt) and with important holdings and strategic alliances in Turkey and China.

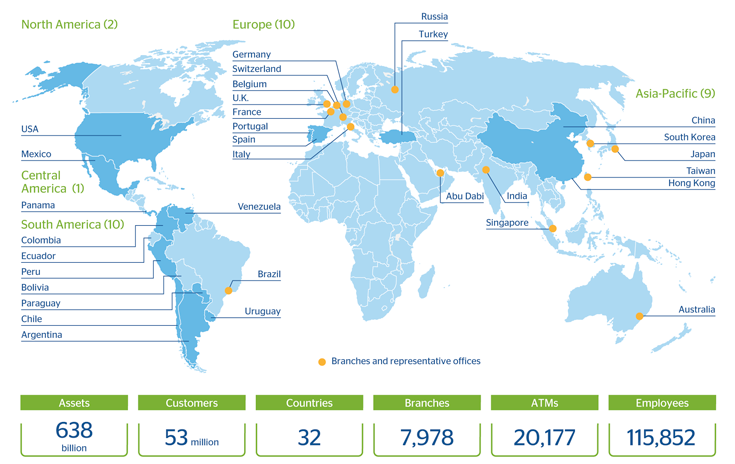

19 BBVA in the World

BBVA is continuously analyzing the market in search of attractive and profitable investment opportunities as part of its policy of active portfolio management, in order to generate maximum shareholder value.

In July 2012, BBVA completed the purchase of Unnim Banc S.A. This has strengthened its commitment to Catalonia, doubling its share in one of the most attractive markets and of the biggest growth potentials in Spain. Unnim brings a million customers to the Group and a business that complements the current franchise in the region perfectly. It makes BBVA the second biggest bank by loans and the third by deposits in the area.

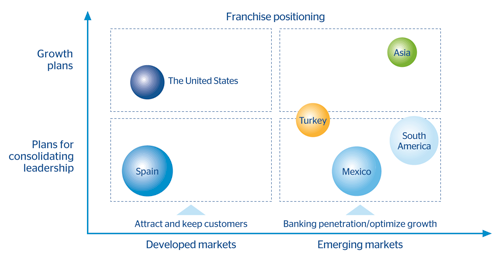

BBVA is very clear about its strategic roadmap for the future: to make the most of its businesses, customers and footprint. In other words, to keep constructing a balanced business portfolio with future growth. This is done by consolidating its leadership within the respective geographical areas, profiting from growth in emerging markets and gaining market share in developed areas. The process will require taking a step forward in service quality, being able to widen the financial products and services offered in line with increasing customer sophistication and demands.

20 A more balanced business portfolio with future growth

2. A business model based on three elements:

- A retail banking model focused on lasting relationships with a very broad customer base (over 53 million customers worldwide). This ensures highly recurrent earnings and very stable funding sources in the form of customer deposits.

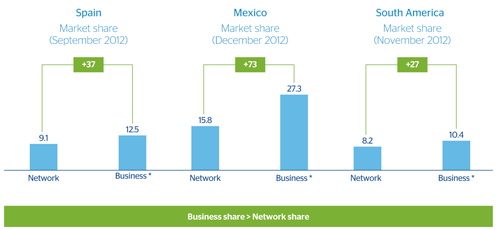

- A distribution network of great capillarity that leads the market in terms of efficiency. It should be mentioned that once more this year BBVA’s share of business has been greater than its network share in every franchise.

21 Network and business shares in the main BBVA franchises

(Percentage)

- Technology is a pillar that has been strongly supported by BBVA in recent years to improve efficiency. The size and scale of the Group have enabled it to undertake significant investments in global technology projects, particularly in the area of transformation and innovation. They have positioned the Bank at the head of technological innovation in the sector.

BBVA invests mainly in four core elements within its technological plan:

a) Improvement of customer experience.

b) Increase in commercial productivity.

c) Risk reduction.

d) Improvement in operational efficiency.

In 2012, BBVA has implemented numerous projects to ensure that these four core elements become a reality. Among them are:

- The implementation of the new BBVA Compass technological platform in all its branches in the United States. This allows processing of transactions in real time, and thus gives this franchise a clear competitive advantage in the US market. The new platform will improve the service provided through differentiated, efficient, faster and customer-centric processes.

- Progress in the Group’s multi-channel distribution model. In Spain the number of customers choosing “BBVA Contigo” as their main channel for relations with the Bank has continued to increase. More than 360,000 customers are already remotely managed by approximately 350 specialized advisers. In Mexico the “Dinero Móvil” BBVA Bancomer plan is boosting access to banking for new users, thus contributing to increase financial inclusion and the level of banking penetration in the country.

BBVA wants to take advantage of all the opportunities technology presents to build a more innovative, more efficient, more customer-centric, and better-quality model. That is why it will continue its commitment to technology, which is the main driver of future change in the industry. The next leaps in efficiency in terms of both revenue and costs will not be through incremental adjustments, but rather through a new model in which the role of remote channels, customization of products and services and the role of the branch will be radically different.

3. A management model based on three elements: prudence, anticipation and a global outlook.

- Prudence with respect to the decisions made on structural risks, credit risk, capital management and corporate transactions.

- Anticipation in terms of the need to anticipate events and to have the flexibility to adapt easily to them.

The strategy of prudence and anticipation has allowed BBVA to easily pass the stress test conducted by Oliver Wyman. Its results were published in September and placed it among the limited number of banks that do not need additional capital, even in the most adverse scenario. This capacity of anticipation has been key to the Bank’s performance over these difficult years. It will continue to be so in the increasingly global and uncertain future.

- The third element in the management model refers to the global outlook, including the concept of cross-cutting approach, which consists of exploiting all the current potential of BBVA’s businesses, customers and footprint. In 2012 the Group has continued to boost the cross-cutting management of its businesses to generate significant synergies, through:

a) The Group’s wholesale businesses, Corporate & Investment Banking (CIB). A new organizational structure has been announced for this area, designed to boost the strengths of the business and maximize the opportunities provided by the new environment. The new organization strengthens the strategic priorities of BBVA CIB: a greater focus on clients as the core element of its value proposition, as well as optimization of its competitive advantages by boosting cross-border business and maximizing wholesale activity in partnership with the Group’s banks and local networks.

b) The Retail Banking business, created last year, has also been transformed in 2012, by combining the Group’s businesses in South America with Global Retail Banking and Innovation. This new area has the following objectives:

- Increase the growth of the franchises in South America and make the most of the opportunities in the region with the support of the corporate units.

- Connect the retail businesses within the Group so that best practices can be easily transferred and boost the development of the global business lines of consumer finance, insurance, asset management and payment channels.

- Innovate with teams dedicated exclusively to constructing the retail banking of the future, and provide global business solutions closely linked to technology.

In short, the retail banking business responds to BBVA’s vision of a customer-centric organization that promotes multi-channel products and services and innovates to offer value solutions and differentiated experiences to its customers. The global management and cross-cutting nature of the retail businesses can be seen in initiatives such as:

- A “Cross-border Synergies project” in CBB, which has established a network of coordinators in 20 countries and provides immediate cross-referencing for customers with international expansion needs and a flexible account opening process across the Group’s various banks. More than 600 companies have benefited from this service so far.

- A “Personal Banking project”, based on a differentiated value proposition adapted to the mass-affluent customer segment, which provides preferential service to the segment’s customers. It has already been launched in Spain, Mexico and Colombia in 2012. It will be launched in Uruguay and Paraguay in the first quarter of 2013 and extended to other geographical areas throughout this year and the start of 2014.

22 Global Outlook in BBVA Group

4. A model of profit subject to principles founded on the absolute principles of integrity, prudence and transparency, whose primary objective is to create value for its shareholders.

BBVA firmly believes that putting principles first in the Group’s governance management is a competitive advantage in itself. One of the values that has become of greatest importance at the present time is being a reliable bank, in other words, a bank that customers, shareholders, employees and citizens can trust. Not only because it meets the targets it sets itself, but also because of the way it does so: by respecting regulations, principles and people.

In a crisis situation like today’s, in which the reputation of the sector has been more negatively impacted than ever, acting and communicating are essential. BBVA has implemented numerous plans and initiatives to this end, including the “Community Impact” project, which aims to improve understanding of BBVA’s impact on the community. To do so it has searched for simple and comprehensible indicators of initiatives in traditional financial activity, such as net jobs generated, the number of people who live in housing financed by the Bank, micro-entrepreneurs funded through BBVA Microfinance Foundation microcredits, etc. These indicators have been presented by the Group’s President and COO at the 2012 AGM and during the presentation of first quarter 2012 results. Moreover, the project only works with indicators verified by BBVA’s external financial auditors. The goal is to be increasingly transparent on relevant subjects and to make progress in recovering the trust lost by some of the stakeholders in the financial sector.

23 Commitment to the community in which we operate

BBVA’s banking model translates into two competitive advantages: recurrent earnings and structural strength

In conclusion, this banking model is based on the four pillars explained above and translates into two competitive advantages: recurrent earnings and structural strength.

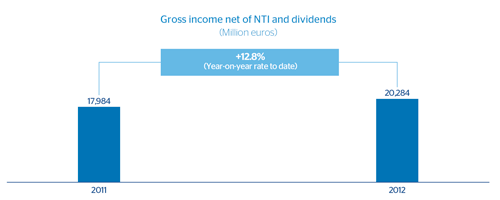

1. Recurrence, because BBVA continues to demonstrate a strong capacity to generate recurrent earnings year after year; earnings that have also allowed it to absorb high levels of loan-loss provisions in 2012 in Spain.

24 Earnings recurrence

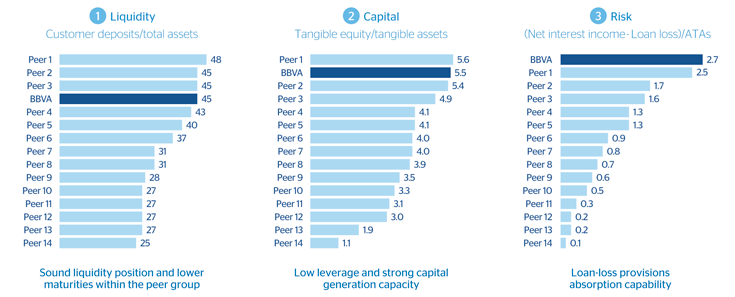

2. Structural strength, because the Group maintains a balanced and well-capitalized balance sheet with risks that are well-known and under control, and with an adequate funding structure relying on its broad customer base. BBVA is in a comfortable liquidity position as well as its capacity to generate capital organically is among the soundest in its peer group. As a result, it has continued to comply with the capital recommendations issued by the European Banking Authority (EBA). And it has done so as one of the few banks in the world that has continued to pay dividends during these crisis years.

25 Structural strength. BBVA Group versus peer group*

(Percentage. September 2012)

BBVA is prepared for leading the new phase of the financial system

In short, this banking model has not only allowed BBVA to record a standout performance during the crisis while maintaining a very sound financial profile and demonstrating a great capacity for resilience in each of its franchises; it has also meant that it can now successfully face the upcoming changes in the short and long term, and continue to be one of the main players in the global financial industry.