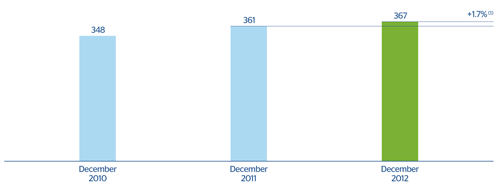

At the close of 2012, gross customer lending amounted to €367 billion, up 1.7% on the figure at the end of 2011. Apart from the buoyant activity in emerging geographical regions, the incorporation of the balances from Unnim and the positive exchange-rate effect have also had a positive impact on year-on-year growth. These effects outweigh the reduced activity in Spain and in the Group’s CIB portfolios.

Customer lending

(Million euros)

Download Excel

Download Excel

|

|

31-12-12 | Δ% | 31-12-11 | 31-12-10 |

|---|---|---|---|---|

| Domestic sector | 190,817 | (0.8) | 192,442 | 198,634 |

| Public sector | 25,399 | (0.4) | 25,509 | 23,656 |

| Other domestic sectors | 165,417 | (0.9) | 166,933 | 174,978 |

| Secured loans | 105,664 | 6.5 | 99,175 | 105,002 |

| Commercial loans | 5,926 | (10.5) | 6,620 | 6,847 |

| Financial leases | 4,245 | (14.3) | 4,955 | 5,666 |

| Other term loans | 36,457 | (12.9) | 41,863 | 46,225 |

| Credit card debtors | 1,666 | 3.1 | 1,616 | 1,695 |

| Other demand and miscellaneous debtors | 2,857 | (2.8) | 2,939 | 2,222 |

| Other financial assets | 8,603 | (11.9) | 9,766 | 7,321 |

| Non-domestic sector | 156,312 | 2.0 | 153,222 | 134,258 |

| Secured loans | 61,811 | 1.9 | 60,655 | 45,509 |

| Other loans | 94,500 | 2.1 | 92,567 | 88,750 |

| Non-performing loans | 20,287 | 29.7 | 15,647 | 15,361 |

| Domestic sector | 15,159 | 37.3 | 11,042 | 10,953 |

| Public sector | 145 | 11.8 | 130 | 111 |

| Other domestic sectors | 15,014 | 37.6 | 10,913 | 10,841 |

| Non-domestic sector | 5,128 | 11.4 | 4,604 | 4,408 |

| Customer lending (gross) | 367,415 | 1.7 | 361,310 | 348,253 |

| Loan-loss provisions | (14,485) | 53.9 | (9,410) | (9,396) |

| Customer lending (net) | 352,930 | 0.3 | 351,900 | 338,857 |

19. BBVA Group. Customer lending (gross)

(Billion euros)

The trends in lending seen in 2012 in the business areas are summed up below:

- The deleveraging process taking place in Spain, and which has been more acute in the latter part of the year, has been partly offset by the incorporation of Unnim balances at the end of July 2012, and the setting up of the fund to finance payments to suppliers. Overall, gross customer lending in the area is down 1.5% over the previous 12 months.

- Performance in Eurasia has been mixed: on the one hand, the wholesale segment in Europe and Asia, and, on the other hand, the retail portfolio, mainly focused on BBVA’s stake in Garanti. Lending activity in CIB declined by 29.9% over the year, due to the economic slowdown and its selective growth strategy focused on certain customers and portfolios. In contrast, gross lending to customers from Garanti is up 15.1% in the same period. At year-end, the loan book for the area had declined 13.0%.

- Mexico has maintained the rate of growth, largely stemming from retail portfolios. Growth is particularly significant in consumer finance and cards and in small businesses. As a result, the area’s lending has shown a positive rise of 8.6% year-on-year (at constant exchange rate).

- South America continues to post significant growth in all geographical areas and in practically all portfolios, although the excellent performance in the retail segment is also worth pointing out. Overall, lending rose 18.6% over the year (at constant exchange rates).

- The United States has once again performed strongly, underpinned by the positive trend in new loan production reported by BBVA Compass in its target portfolios, i.e. in commercial loans and residential real estate. Therefore, and despite the continued slump in the construction real-estate sector, the loan book in BBVA Compass has grown 4.1% since the end of 2011 (also at constant exchange rates).

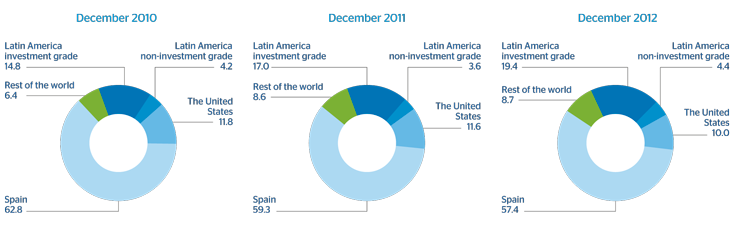

In short, a domestic sector undergoing steadily declining quarter after quarter, against a non-domestic sector benefiting from the good performance in emerging economies.

20 BBVA Group. Geographical breakdown of customer lending (gross)

(Percentage)

Lastly, non-performing loans have shown an upward trend since the end of 2011, with a rise of 29.7% year-on-year. This trend is caused above all by the performance in the domestic sector, which is strongly impacted by the deterioration in the euro zone economy and, particularly, in Spain. Furthermore, since the end of July this heading has also included Unnim balances, although it is important to stress once again that they have a high coverage ratio, and part of them are guaranteed by an asset protection scheme (EPA). The year-on-year increase in NPA ratios in the non-domestic sector is mainly due to the exchange-rate effect and the classification, in the last quarter of 2012, of specific risks in Portugal as subjective non-performing loans.