In 2012 the economic slowdown became more pronounced, particularly in the Euro Zone, where the crisis was aggravated by the doubts regarding the capacity of the peripheral countries to undertake fiscal and structural reforms. This situation led to new falls in interest rates in Europe, where they stood at all-time lows, as well as in the United States and Mexico. In South America, central banks maintained an expansive policy, despite upward pressure on inflation.

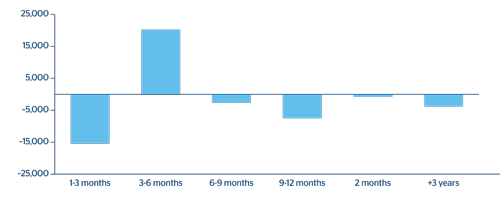

The changes in market interest rates affect net interest income and the book value of entities. This potential impact is included in the structural interest-rate risk. Its main source of risk arises from different maturities or depreciation in assets and liabilities in the banking book and off-balance-sheet positions. The accompanying chart shows the gaps in BBVA’s structural balance sheet in euros.

31 Maturity and repricing gaps of BBVA’s structural balance sheet in euros

(Million euros)

A financial institution’s exposure to adverse changes in market rates is a risk inherent to its business, while at the same time represents an opportunity to generate value. That is why structural interest-rate risk should be managed effectively and retains a reasonable relation to its equity and expected earnings.

The management of structural risks in BBVA Group is handled by the Balance-Sheet Management unit, within the Financial Management area. Through the Asset and Liability Committee (ALCO), the unit is in charge of maximizing the Bank’s economic value, preserving net interest income and guaranteeing the generation of recurrent earnings. With this aim, the Financial Management area assesses possible alternatives and proposes the most appropriate actions based on its expectations, balancing expected economic results and the impact on the risk level. This is done while adapting to the established risk profile, as well as the strategy and policies defined by the Group’s management bodies. BBVA has a transfer pricing system that centralizes the Bank’s interest-rate risk on ALCO’s books and is designed to facilitate this task.

Within the Global Risk Management corporate area, the Corporate Risk Management (CRM) unit is responsible for controlling and monitoring structural interest-rate risk with the aim of keeping the Group’s solvency, supporting its strategy and ensuring the successful development of its business. To do so, it acts as an independent unit, which guarantees a proper separation between the risk management and control functions, as recommended by the Basel Committee on Banking Supervision. CRM designs the measurement models and systems, develops the monitoring, information and control policies, and prepares the structural interest-rate risk measurements used by the Group’s management. At the same time and through the Risk Management Committee (RMC) carries out the function of risk control and analysis, reporting to the main management bodies such as the Executive Committee and the Board of Directors’ Risk Committee.

BBVA Group’s structural interest-rate risk management procedure has a sophisticated set of metrics and tools that enable its risk profile to be monitored precisely. The model is based on a series of deeply analyzed assumptions designed to characterize the balance sheet more accurately. Interest-rate risk measurement includes probabilistic metrics as well as sensibility measures in response to a parallel shift of +/- 100 basis points of the market interest rate curves. The model regularly measures the Bank’s earnings at risk (EaR) and economic capital (EC), defined as the maximum adverse deviations in net interest income and economic value, respectively, for a particular confidence level and time horizon. These deviations are obtained by applying a simulation model of interest-rate curves that takes into account other sources of risks apart from directional movements, such as changes in the slope and curvature, and also the diversification between currencies and business units. The model is regularly subjected to internal validation that includes backtesting.

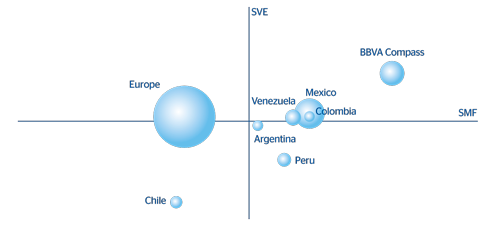

Chart 32 shows the sensitivity profile of the main franchises of BBVA Group.

32 BBVA Group. Structural interest-rate risk profile

EVS: Economic value sensitivity (%) of the franchise to +100 basis points.

Size: Core capital to each franchise.

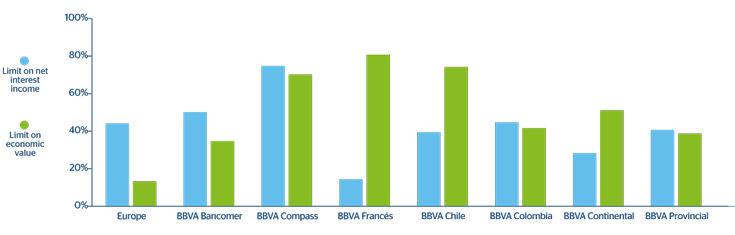

The risk appetite of each franchise is determined by the Executive Committee through the limits structure. Thus the maximum negative impacts, in terms of both earnings and value, are controlled in each entity. In 2012 active balance-sheet management has enabled exposure to remain aligned with the Group’s target risk profile, as shown in Chart 33.

33 Structural interest-rate risk. Average use of limits in 2012

Interest rate risk measurement is supplemented by analysis of BBVA Research’s scenarios, as well as stress testing, which evaluates extreme scenarios of a possible breakthrough in both interest-rate levels and historical correlations and volatility.