Strong franchise, helps us outperform

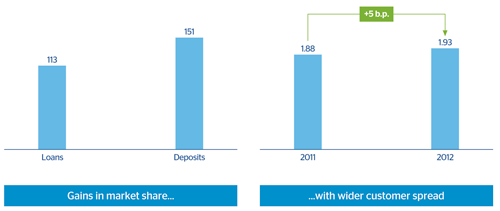

37 Market share. Lending and deposits(Year-on-year change. Figures as of |

Customer spread

|

|---|

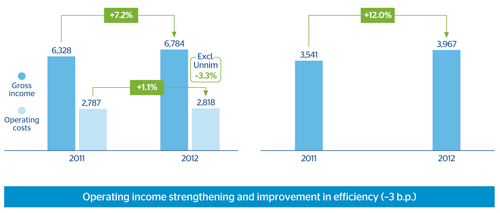

Containment of costs, which grew slower than revenue

38 Gross income and operating costs(Million euros) |

Operating income(Million euros) |

|---|

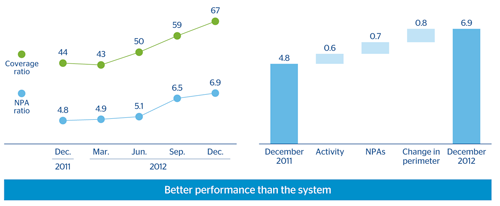

NPAs are in line with expectations

39 NPA and coverage ratios(Percentage) |

NPA ratio breakdown(Percentage) |

|---|

Income statement

(Million euros)

|

|

Accumulated | Year-on-year change 2012-2011 | |

|---|---|---|---|

|

|

2012 | Absolute | Percentage |

| Net interest income | 4,836 | +445 | 10.1 |

| Gross income | 6,784 | +457 | 7.2 |

| Operating income | 3,967 | +426 | 12.0 |

| Income before tax ex provisions related to real estate | 1,699 | –382 | –18.4 |

| Net attributable profit (adjusted) | 1,211 | –267 | –18.2 |

| Net attributable profit | –1,267 | –2,619 | n.m. |