Activity in the United States is carried out mainly by BBVA Compass, which accounts for 95% of the business volume and 81% of earnings in the area. Due to the relative contribution of BBVA Compass, most comments in this section refer to this business unit.

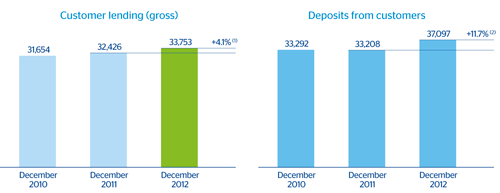

At the close of December 2012, gross customer lending in BBVA Compass was up 4.1% to €33,753m. The bank continues to focus its commercial effort on its targeted portfolios. Construction real-estate fell year-on-year by 48.2%. In contrast, commercial loans increased by 24.5% year-on-year and residential mortgages by 19.0% over the same period.

49 BBVA Compass. Loan mix

(Percentage)

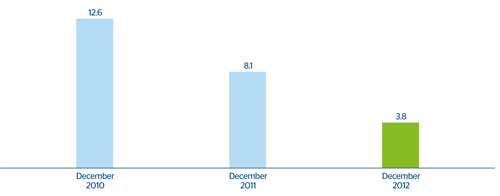

50 Developer loans over total BBVA Compass loan portfolio

(Percentage)

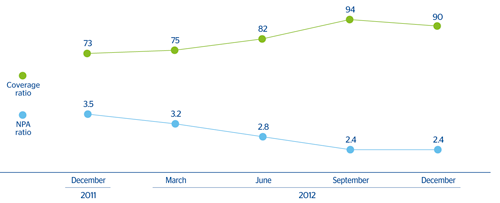

Asset quality in the area improved considerably during the year. Total non-performing loans decreased by 39.5% compared with the figure for 2011 (at current exchange rates). Thus the NPA ratio improved 114 basis points, closing the year at 2.4%. The coverage ratio reached 90% and the accumulated risk premium at year end, 0.23% (0.89% at the close of 2011).

51 The United States. NPA and coverage ratios

(Percentage)

Customer deposits in BBVA Compass also grew by 11.7% over the last 12 months. As of 31-Dec-2012 they stood at €37,097m. Of this total, 29.1% are non-interest bearing deposits, which performed better over the year, with a growth of 12.3%.

52 BBVA Compass. Key activity data

(Million euros at constant exchange rate)

(2) At current exchange rate: +9.6%.

53 BBVA Compass. Deposit mix

(Percentage)