Asset Management

Asset Management is BBVA’s provider of asset management solutions. It integrates structuring and management of mutual funds, pension funds and the third-party funds platform Quality Funds. The unit has solutions tailored for each customer segment, based on constant product innovation as the key to success.

Despite recovery in capital markets, 2009 has been a very difficult year for the mutual fund industry. This has been the result of lack of confidence among investors and the huge competition for capturing savings and mitigating liquidity problems. At the end of the year, total assets under management in Spain stood at €49,972m, a decline of 1.9% against the close of 2008. Of this amount, mutual funds account for €32,797m. BBVA ended the year as the leader in the Spanish market with a 19.3% market share.

The average return on its mutual funds in 2009 was higher (5.5%) than the net weighted return of the seven biggest managers (4.9%), which account for 62% of the market. More than 82% of BBVA Asset Management’s mutual funds (excluding guaranteed funds) are in the first two quartiles of ranked funds by net returns. Moreover, a very significant part of BBVA’s funds have lower volatility levels.

The unit’s activity regarding new products has been concentrated on the needs presented by clients at all times. Some of the funds launched included: BBVA Bono Cash (money market), BBVA Bonos Largo Plazo Gobiernos II (long term government bonds II), BBVA Bonos Corporativos 2011 (corporate bonds 2011), and BBVA Bonos 2014 (Bonds 2014). Several of the structured bonds launched are BBVA Oportunidad Europa BP (Europe opportunity) and BBVA Selección EmpresasBP (selected companies).

Quality funds, BBVA’s third-party fund platform, was reinforced in order to offer customers quality products from other providers in addition to the Group’s catalog. Therefore, and to boost the acceptance of other managers’ funds, a specialized operational risk analysis team was incorporated. Likewise, the analysis and selection department, fund management and funds of funds departments are being expanded, as they form the basis of the platform’s value offer.

In regards to pension funds, the assets managed in pension funds in Spain were up 6.8% year-on-year to €17,175m. Of this amount individual plans account for €9,983m and employee and associate schemes €7,191m. BBVA continues being leader for the whole of pension plans, with a market share of 18.6% as at December 31, 2009, and it its two principal types: employee schemes (22.7%) and individual plans (16.5%).

Industrial and real estate holdings

This unit devotes itself to diversifying the area’s businesses, as well as to creating value in the medium and long terms through the active management of its portfolio of industrial holdings and holdings in private equity funds and international real estate. Its management fundamentals are profitability, asset turnover, liquidity and optimal use of economic capital.

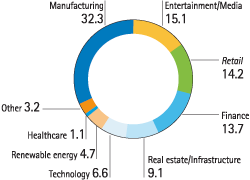

It currently manages a portfolio of holdings in the industrial sector of more than 50 companies in various sectors, including Corporación IBV, Bolsa y Mercados Españoles (BME), Técnicas Reunidas, Tubos Reunidos and Desarrollo Urbanístico Chamartin (DUCH). As at December 31, 2009 the capital gains of the Industrial and Real Estate Holdings increased 71%, easily beating the revaluation of the Spanish stock index (IBEX-35) during the same period (29.8%). In 2009, it invested approximately €25 million.

In international funds it has invested $120 million in diverse sectors in companies such as: American Gilsonite Company (mining sector), Celeritas (communication), Project Health (healthcare), Taco Bueno and Castro Cheese (food products). The unit also managed the Group’s holdings in the CITIC Fund real estate funds, with a current investment of approximately $16 million in real estate projects in China.

Asia

Lastly, in the fourth quarter of 2009, BBVA’s holding in the share capital of CNCB was consolidated by the equity method, as it became classified as substantial holding. BBVA raised its investment in China Citic Bank (CNCB) from 10% to 15% (entailing roughly €1,000m) by executing its purchase option of HK$6.45 per share which will be effective from March 1, 2010.

Asia is expected to represent approximately 8% of the Group’s net attributable profit within 3 years. BBVA is working towards this goal on various fronts. Among them is the recent signing of two joint ventures, one in auto finance and the other in private banking.