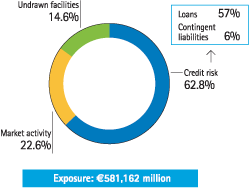

BBVA’s maximum exposure to credit risk stood at €581,162 million at December 31, 2009, a reduction of 1.0% compared with the end of 2008. Customer credit risks (including contingent liabilities), which account for 62.8%, fell 3.7% over December 2008, and potential exposure to credit risk in market activities (22.6% overall), including potential exposure to derivatives (including netting and collateral agreements) grew by 13.4% due to fixed-income exposure, while undrawn facilities (14.6% overall) fell by 8.4%.

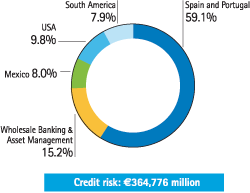

The geographic distribution of credit risk shows that the Americas have gained in weight, at nearly two percentage points over the year. The U.S. increased its participation through the acquisition of Guaranty Bank business in the third quarter of 2009. Overall, the Americasaccount for 25.7% of the Group’s overall credit risk, compared with 23.9% at the close of 2008. It is important to stress that most of the risk in the Americas (83.8%, compared with 83.2% in 2008) is located in investment grade countries.

A breakdown of customer loans by sector at year-end 2009 is given in the table below. The loan book in the local private sector in Spain stood at €183 billion, and the risks were highly diversified by sector and counterparty type.

The distribution by portfolio shows that individuals’ risk accounts for 35% of total credit risk, residential mortgages being particularly important (27% overall, compared with 25% in December 2008). The LTV of this portfolio is at similar levels to December 2008, at around 54%, 51.5% in Spain (52.4% in 2008). The portfolio with LTV greater than 80% accounts for less than 20% of the total. The vast majority of the transactions’ destination is for the purchase of a first home (95%).

The developer segment in Spain (included in corporates) represents about 5% of total Group lending and 8% of total lending in Spain. Within this segment, finished developments has a significant weight (47%), with a LTV normally below 80%. It represents a lower risk than developments underway (24%) and land (29%). In the land segment most is urban land (75%).

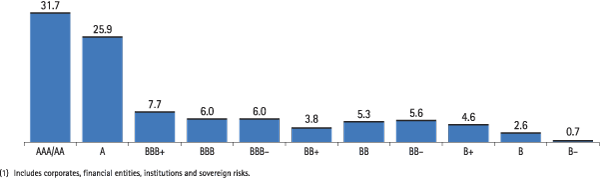

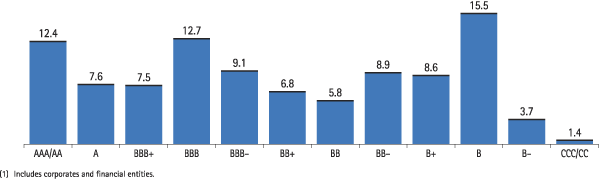

The breakdown by rating of exposure of the parent and subsidiaries in Spain, including corporates, financial entities, institutions and sovereigns shows 57.6% of A or better ratings.

The breakdown by rating of SMEs and developer segment for the parent and subsidiaries in Spain is also shown.

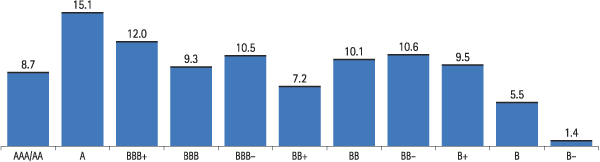

The breakdown of the loan book by rating in Mexico with corporates and financial institutions is shown in the chart.