Consumer finance

The Consumer Finance unit manages consumer finance and on-line banking, via Uno-e, Finanzia and other subsidiaries in Spain, Portugal and Italy.

Against the complex backdrop of 2009, the income statement for 2009 shows operating income at €162 million, reflecting a 41.9% year-on-year increase, due to very positive growth in the net interest income (up 17.4% year-on-year) and a reduction in costs (down 13.1%). The application of strict criteria for non-performing assets places the attributable income at –€181 million, despite the 55.2% reduction of non-performing assets in the third and fourth quarters of 2009.

In Spain, the loan portfolio was €6,387 million, with a year-on-year growth of 2.9%. In the vehicle prescription business, in a year of a downturn in the number of new registrations (–17.8%), sales reached €972 million, with marked quarter-by-quarter growth. This has allowed BBVA to lead the market in new lending, with a 17.0% share (according to ASNEF data at 30-9-09). The product range for this business has been completed with a new unemployment and disability insurance. Equipment financing is at €225 million and was impacted by the fall in business investment. As for equipment renting, new operations increased by 16.6% to €361 million, based in part on the marketing of a new technology renting (Rent&Tech) in collaboration with Solium. In car rental, a fleet of 33,656 units is managed in Spain. BBVA Autorenting has strengthened agreements with the branch network for the sale of vehicles from renting operations.

Uno-e’s loan portfolio stands at €1,073m, with sales for the year at €1,733 million, of which mortgages account for 5.5% (up 127.0% year-on-year). Customer funds under management or brokered rose to €1,246m (up 1.2%). Also noteworthy are the 15.3% increase in mutual funds and 24.6% increase in transactional deposits, as a result of the campaign which gives a bonus of 20% of the paycheck for customers who pay it directly into their account together with 3 regular bills.

In Portugal, BBVA Finanziamento’s loans are up 12.5% in the year to €493m. The co-branded credit card business has been consolidated, with the signing of agreements with Repsol Portugal and Liberty Seguros. In Italy, BBVA Finanzia SpA’s loans are up 40.6% to €404m with total sales of €228 million (+128%). Renting companies reach a fleet of 14,477 vehicles as at 31-12-09 (up 16.3%).

Insurance

This unit has the strategic objective of being the leader in the insurance business among the BBVA’s different customer groups, and comprises several companies that manage direct insurance, brokerage and reassurance, and use the different networks with an extensive range of insurances.

The amount of earnings this area contributed to the Group in 2009 totals €523 million: €497m from in-house policies and €26m in brokerage on third-party policies. Thus, net attributable profit rose 2.7% to €263m for the year.

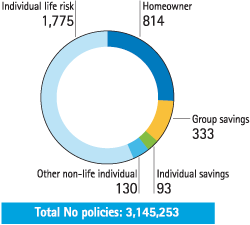

Premiums issued during the year have grown 25% to €1,367 million, of which €1,111 million (up 27.2% in the year) correspond to individual policies (life and non-life) and €256m to collectives (up 16%). BBVA Seguros is the market leader in individual life insurance policies, with a share of 13.0% as at September 2009 (most recent data available). The volume of funds under management in private savings policies reached €8,410 million, of which €3,259 million (up 4.7%) correspond to individual clients and the rest to group savings policies. Moreover, BBVA has brokered premiums for €196 million.

In order to become a comprehensive provider of insurance solutions (life and non-life), the product catalog has been complemented with new modalities that adapt to the customers´ needs in terms of price and coverage. A specialized telephone platform has also been implemented to provide customers the best solution, together with the consulting provided at the branches. In this regard, the new launches for individuals have included Seguro Coche BBVA Gama Terceros (BBVA Third-Party Range Car Insurance), Seguro Vivienda Plus (Housing Plus Insurance) and Seguros Personales Plus Fidelización (Loyalty Plus Personal Insurance); and for the self-employed segment, the essential range in the Más Cobertura Profesional (Additional Professional Insurance). New unemployment and temporary disability insurance policies have also been developed, like the one distributed through Consumer Finance; or that which is being incorporated free-of-charge for young people under the Hipoteca Blue Protegida BBVA. BBVA Broker, in the business segment, is the Group’s insurance broker in Spain which provides companies personalized services (coverage for assets and properties, installment payments collections, work related risks, etc.) through an extensive catalogue of products. Moreover, a product for helping companies meet the requirements of the Spanish Environmental Responsibility Act is being developed.

In insured savings, BBVA Seguros is consolidating its position as leading entity for expected management, as in the Individual Systematic Savings Plans (PIAS), in which premiums for €181 million (up 27% year-on-year); and insured individual incomes with €346 million in premiums (up 233% year-on-year).

The unit achieved more than 3.1 million policyholders, with an increased quality of service, as reflected by the complaint-free resolution of more than 94% of life insurance claims reported and the complaint-free resolution of 99% of home insurance policies. Periodic independent measurements grant the home insurance policies a score of 7.8 out of 10 for service received during the claims processing.

BBVA Portugal

BBVA Portugal has experienced positive growth in 2009. Appropriate price management in times of low interest rates helped net interest income in the unit to rise 0.2% year-on-year to €85m. Together with an increase in net fee and commissions income and cost controls, operating income increased 4.0% to €55m and attributable profit came to €23m (€25m in 2008).

Lending to customers increased to €6,063 million (up 2.7%), with a 9.5% increase in residential mortgages thanks to the launch of several new campaigns. These include the Nos Adaptamos (We Adapt) and Adapte su Crédito (Adjust your Loans) campaigns that allow clients with mortgages to lower their monthly quotas or request additional loans. In order to make consumer loans more dynamic, several actions to strengthen the use of credit cards have been carried out, in addition to the credit campaigns including Oferta, Revolving and Crédito Liquidez BBVA. It expanded the product range for SMEs with a new accounts payable financing service and a range of insurance policies in conjunction with AXA-Vitalplan Corporate and CESCE. Important operations in investment banking include those signed with Portucel, GALP, the Jerónimo Martins Group and Emparque for the purchase of Cintra Aparcamientos.

For customer funds, which maintains a similar amount to that at close of 2008 (€2,542 million at 31-12-09 and €2,571 million at 31-12-08), the unit has developed an entire line of products for clients with a conservative risk profile with deposits including Nos Adaptamos, 12 month Euribor and Depósito Fortaleza. Customers who seek greater profitability, and assume greater risks, can access deposits like Acciones Europa BBVA, Dual Selección Europa and Cabaz Europa. As for mutual funds, BBVA Gestión has been chosen by Morningstar Inc. as the top asset management entity in the country.