The credit risk assessment in OTC financial instruments is made by means of a Monte Carlo simulation, which enables calculation not only of the current exposure of the counterparties, but also their possible future exposure to fluctuations in market variables.

The model combines different credit risk factors to produce distributions of future credit losses and thus allowing a calculation of the portfolio effect; in other words, it incorporates the term effect (the exposure of the various transactions presents potential maximum values at different points in time) and the correlation effect (the relation between exposures, risk factors, etc. are normally different to 1). It also uses credit risk mitigation techniques such as netting and collateral agreements.

The equivalent maximum credit risk exposure to counterparties in the Group as of December 31, 2009 stood at €42,836 million, a fall of 9% on year-end 2008. The equivalent maximum credit risk exposure in BBVA S.A. is estimated at €38,259 million. The overall reduction in terms of exposure due to netting and collateral agreements was €27,026 million.

The net market value of the instruments mentioned in the BBVA S.A. portfolio on December 31, 2009 was €2,981 million and the gross positive market value of the contracts was €36,189 million.

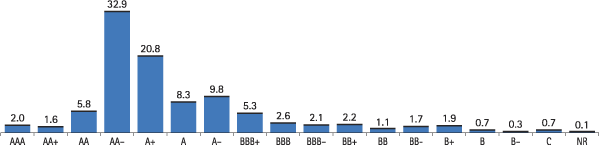

The table below shows the distribution by maturity of the equivalent maximum exposure amounts under OTC financial instruments.

The counterparty risk assumed in this activity involved entities with a high credit rating (equal to or above A- in 81% of cases). Exposure is concentrated in financial entities (83%), and the remaining 17% in corporations and customers is suitably diversified.

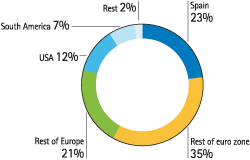

By geographical area, the highest exposure of BBVA S.A. was in Europe 79%) and North America (12%), which together accounted for 91% of the total.