Capital generation in the financial sector was a key factor in 2009. This can be seen from the concern shown by some regulatory bodies that have carried out tests to check capital adequacy levels of banks in extreme situations, such as the American stress tests or the tests carried out by the Committee of European Banking Supervisors (CEBS) on European banks.

Despite the capital injections by governments, the weight has been lower than in 2008, as private capital increases with large discounts have been the rule. The year has also been one in which financial institutions have maintained prudent capital policies and called on the market to increase or at least maintain their capital adequacy ratios.

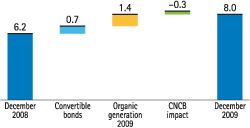

Against this background, BBVA has been one of the few banks that has not made any capital increase in the last two years and, more importantly, the Group has generated core capital organically throughout the year, with a rise of +140 basis points.

BBVA closed 2009 with a net attributable profit of €4,210 million, of which €1,012 million were distributed to shareholders in cash through three interim dividend payments amounting to €0.27 per share. In addition, a final dividend payment of €0.15 per share for 2010 is planned against 2009 earnings. The shareholder remuneration policy has strengthened the Group’s capital position, which in turn has enabled it to ride the economic slowdown and increased level of defaults in a more comfortable position. Retained earnings in 2009 were €3,198 million, which has translated into improvement in capital ratios over the year, thanks to this organic generation exceeding ordinary expenses and extraordinary net investments during the reference period.

In terms of investments, the Group has continued its expansion plan in Asia and the United States. In January, it increased its holding in China Citic Bank (CNCB) from 9.93% to 10.07%, which thus entered the capital base as a substantial shareholding and therefore increased the deductions by approximately €1,900 million: 50% in Tier I and a further 50% in Tier II. In addition, in the fourth quarter the consideration of CNCB as one of the Group’s subsidiaries generated goodwill that reduced the core capital by 30 basis points. Also, in December, BBVA confirmed the exercise of the purchase option on CNCB, by which it acquired an additional 4.93% of the Chinese bank for a holding of 15%. The payment is expected to be made over the first quarter of 2010. In the United States, the purchase of the banking operations of Guaranty Financial Group (Guaranty) from the Federal Deposit Insurance Corporation (FDIC) was announced on August 22, 2009. This amounted to $2,400 million in risk-weighted assets (RWA). It is important to stress that the impairment of goodwill in the United States in the fourth quarter, with the consequent impact on results, has a neutral effect both on core capital and the rest of the capital base.

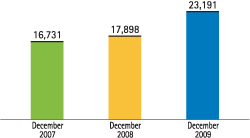

As a result of all the above, as of December 31, 2009, the eligible capital of BBVA, calculated according to the Basel II capital agreement rules was €39,440 million, €4,407 million more than on December 31, 2008. Over the year the RWA increased by 1.3% to €291,026 million euros, representing slightly over 54% of the Group’s total assets. With these RWA the capital requirements (8% of RWA) stand at €23,282 million. There is thus a capital surplus of €16,158 million, 69% above the minimum levels required, and a clear improvement compared with the past year, thus reflecting the Group’s sound capital position.

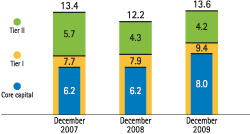

Core capital at year end was €23,191 million, 8.0% of RWA, i.e. 180 basis points up. The main reasons for this growth were, first, the Group’s capacity for organic generation reflected in the good results obtained over the year (+140 basis points in the year, of which 30 basis points were consumed by the impact of goodwill from CNCB); and second, the issue of €2 billion euros of bonds mandatorily convertible into BBVA shares in September (+70 basis points). With this operation, BBVA also anticipated the effect of possible more restrictive capital regulations in the future and reflects the Group’s diversity of sources for increasing its capital base.

If the preference shares are incorporated into the core capital, Tier I increases to €27,254 million euros, 9.4% of RWA, vs. 7.9% in the previous year. In October, BBVA successfully concluded the offer to exchange preference shares placed on the institutional market. As a result of this exchange, BBVA issued two preference securities of €645 million and €251 million pounds sterling, both with an early repayment option at 5 years. As a result, preference securities represent 18.8% of the total of Tier I capital, compared with 23.8% the previous year.

Tier II, which mainly includes subordinated debt, valuation adjustments and the excess generic provisions, amounted to €12,186 million at year-end, 4.2% of RWA, 10 basis points less than in 2008. The ratio fell due to the deduction for CNCB and the lower surplus from generic provision; but there was also a positive impact on complementary capital through the increase in unrealized capital gains over the year and a new issue of 2,614 million mexican pesos of subordinate debt by BBVA Bancomer in June (which can be included as Tier II in the Group’s capital base).

Due to all the above, the BIS II ratio remains at a high level, at 13.6% of RWA at the close of 2009, a growth of 1.4 percentage points over the year.

Thus the capital position of BBVA has improved in 2009 thanks to moderate growth in balance sheet risks and the policy of capital retention announced for the year. This enabled capital to be generated organically and reflects the Group’s sound solvency position, despite the unfavorable economic climate, so that it can continue to remunerate shareholders without diluting their participation.

Ratings

BBVA remains one of the financial entities with superior ratings.

Ratings

|

|

Long term | Short term | Financial strength | Outlook |

|---|---|---|---|---|

| Moody’s | Aa2 | P-1 | B- | Negative |

| Fitch | AA- | F-1+ | A/B | Positive |

| Standard & Poor’s | AA | A-1+ | - | Negative |