The probability of default (PD) is a measure of credit rating that is assigned internally to a customer or a contract with the aim of estimating the probability of non-performing within a year. The PD is obtained through a process of scoring and rating.

Scoring

This tool is a statistical instrument focused on estimating the probability of default according to features of the contract-customer binomial. They are focused on management of retail credit: consumer, mortgages, credit cards of individuals, loans for businesses, etc. There are different types of scoring: reactive, behavioral, proactive and bureau.

The main aim of reactive scoring is to forecast the credit health of credit applications submitted by customers. It attempts to predict the applicant’s probability of default if the application were accepted (they may not be BBVA customers at the time of application).

The level of sophistication of the scoring model and its capacity to adapt to the economic context enables it to give more accurate customer profiles and improve the Bank’s capacity to identify different levels of creditworthiness within specific groups (young people, customers, etc.). The result is a significant improvement in the discrimination capacity of tools in groups of particular importance to the business.

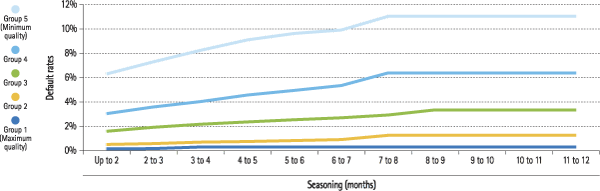

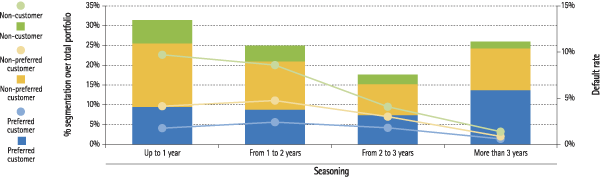

The accompanying charts show default rates of some of the reactive scoring tools used by the Group. They show, for example, that both the loan seasoning and the score can serve to assess the risk of a retail-type operation. The first chart shows the default rates at one year for credit cards of BBVA Bancomer customers who applied for them at the branch and for whom there was bureau information. The second chart shows the different levels of default shown by groups with different levels of bundling to BBVA Spain, from the highest for the non-customer segment, to the lowest for the preferred customers.

A feature of reactive scorings is that the default rates of the various segments tend to converge over time. In BBVA, this loss of screening capacity is mitigated by combining reactive with behavioral and proactive scorings.

Behavioral scorings are used to review contracts that have already been granted by incorporating information on customer behaviour and on the contract itself. Unlike reactive scoring, it is an a posteriori analysis, i.e. once the contract has been awarded. It is used to review credit card limits, monitor risk, etc. and takes into account variables directly linked to the operation and the customer that are available internally: the behavior of a particular product in the past (delays in payments, default, etc.) and the customer’s general behavior with the entity (average balance on accounts, direct debit bills, etc.).

Proactive scoring tools take into account the same variables as behavioral scorings, but they have a different purpose, as they provide an overall ranking of the customer, rather than of a specific operation. This view of the customer is supplemented by calibrations adapted to each product type. The proactive scorings the Group has available enable it to monitor customers’ credit risk more precisely, to improve risk screening processes and to manage the portfolio more actively, by offering credit facilities adapted to each customer’s risk profile.

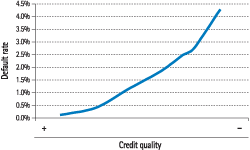

By way of an example, the charts depict the default probability curve from proactive scoring for consumer finance of private individuals implemented in Spain.

The so-called bureau scoring models, widely used in the Americas, are also of great importance. This kind of tool is similar to the scorings explained above, except that while the latter are based on internal information from the Bank itself, bureau scoring requires credit information from other credit institutions or banks (on defaults or customer behavior). This information is provided by credit agencies that compile data from other entities. Not all banks collaborate in supplying this information, and usually only participating entities have access to it. In Spain, the Bank of Spain’s Risk Information Center (CIRBE) makes such information available. The bureau scorings are used for the same purpose as the other scorings, i.e. authorizing operations, setting limits and monitoring risk.

A correct management of the reactive, behavioral, proactive and bureau tools by the Group helps obtain updated risk parameters adapted to economic reality. This results in precise knowledge of the credit health of operations/customers. This task is particularly relevant in the current economic situation, as it can identify the contracts and customers that are in difficulties, and thus the necessary measures can be taken to manage risks that have already been assumed.

Rating

These tools are focused on wholesale customers: companies, corporations, SMEs, the public sector, etc., where the defaults are predicted at the customer rather than contract level.

The risks assumed by BBVA in the wholesale portfolios is classified in a standardized way by using a single master scale for the whole Group that is available in two versions: a reduced one with 17 degrees; and an extended one, with 34. The master scale aims to discriminate the different credit quality levels, taking into account geographical diversity and the different risk levels in the different wholesale portfolios in the countries where the Group operates.

The information provided by the rating tools is used when deciding on accepting operations and reviewing limits.

Some of the wholesale portfolios managed by BBVA are low default portfolios, in which the number of defaults is low (sovereign risks, corporations, etc.). To obtain the PD estimates in these portfolios the internal information is supplemented by external information, mainly from external rating agencies and the databases of external suppliers.

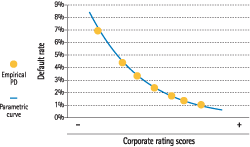

As an example, on the left is the rating tool’s parametric curve for defaults of BBVA Bancomer corporates by internal score assigned.

The economic cycle in PD

An important metric for correct risk management is the average default probability throughout an economic cycle, as it is a measure that allows the effects of economic and financial turbulence to be lessened when measuring credit risk, such as for example capital volatility.

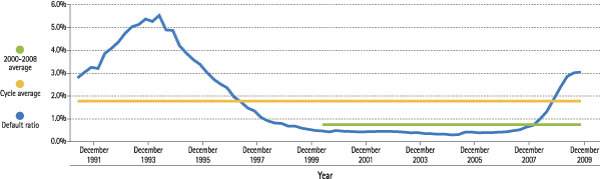

The probability of default varies according to the cycle: it is greater during recessions and lower at boom periods. The adjustment process to transfer the default rates observed empirically to average default rates for the cycle is known as cycle adjustment. The cycle adjustment uses sufficiently long economic series related to the default of portfolios, and their behavior is compared with that of the defaults in the Entity’s portfolios. Any differences between the past and future economic cycles may also be taken into account, thus giving the focus a prospective component.

The chart above illustrates how cycle adjustment works through the behavior of the series of the ratio of doubtful mortgage loans granted, as published by the Bank of Spain. This adjustment to the historical cycle aims to correct the difference between the average of this ratio throughout an economic cycle (for example, in 1991-2009) and the average in the period available in the databases used for the estimate.