Expected losses in the non-doubtful loan book expressed in attributed terms and adjusted to the economic cycle average, stood at €2,400 million euros at the close of December 2009, an increase of 8.2% compared with the same date in 2008.

The main portfolios of the BBVA Group experience use of expected loss and economic capital, as shown in the accompanying table.

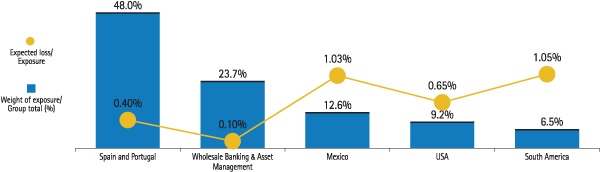

The use of attributable expected losses by areas of business as of December 31, 2009, was as follows:

- Spain and Portugal, with an exposure which accounts for 48.0% of the total, had an expected loss to exposure ratio of 0.40%.

- WB&AM accounted for 23.7% of exposure, with a ratio of expected loss to exposure of 0.10%.

- Mexico had a weight of 12.6% and a ratio of 1.03%.

- The United States had a weight of 9.2% and a ratio of 0.65%.

- South America had a weight of 6.5% and an expected loss ratio of 1.05%.