Risk management in insurance serves a fourfold purpose:

- Identification, evaluation and assessment of the risks of the product offering and new products in Group companies which operate in this activity. The methodology used must be validated at the corporate level.

- Inclusion of risk premium into product prices.

- Setting limits and controls in keeping with the risk profile BBVA is aiming for, appropriate for the specific features of insurance products (maturities, underlying assets and the necessary actuarial calculations).

- Risk focus, taking account of the business units’ information requirements and those of the different regulators.

The year 2009 featured a closer cooperation and deeper understanding of the knowledge of risks between the Central Risk Unit and the Pensions and Insurance business in the Americas, as a result of teamwork made possible during visits to the various subsidiaries. Work has continued in assessing both pension insurance products such as life annuities, and risk insurance. There has also been work on adapting the tools to the specific situation of each subsidiary and on the analysis of the impact of possible biometric changes in each of the portfolios.

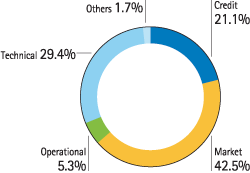

Economic capital in insurance activity in 2009 came to €881 million, an increase of 8.9% compared with the previous year, mainly due to the increase in the volume of business. Economic capital by market risk represented 42.5% of the total. Technical risk accounted for 29.4%, credit risk 21.1% and operational risk 5.3%.