Worldwide, this activity in 2009 continued on the events of 2008 and featured uncertainty on a number of fronts: how the exit from the financial crisis would be managed, banks bailouts, and the impact of possible regulatory changes. In an atmosphere of concern for liquidity and credit risk, portfolio management has been characterized by the aim of achieving an adequate rotation and continuous adaptation to the environment, with reductions in credit risk levels and an attempt to find positions in liquid and secure instruments. In a year of reimbursements, the aim at all times was to provide liquidity for customers, even at times when the liquidity of the underlying instruments did not run parallel. For this reason, portfolios were structured with this objective in mind. BBVA maintains a strong commitment to its duty as trustee for its customers, only assuming risks in third-party portfolios that can be correctly identified, measured and valued.

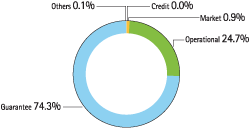

Economic capital in the Asset Management unit increased by 25.8% in 2009 to €78 million. As a result of market conditions, there has been a significant increase in economic capital attributable to guarantee risk. This now represents 74.3% of the total, while the operational risk has reduced, due to the application of the new internal model, to 24.7% of the unit’s total economic capital.