By incorporating the other items, income before tax reached €5,736 million in 2009, 17.2% lower than the €6,926 million recorded in 2008. The corporate tax rose to €1,141 million and the portion corresponding to minority interests is at €385 million, making the net attributable profit for the Group in 2009 €4,210 million, or €5,260 million excluding the €1,050 of negative one-offs.

All business areas, except the United States due to the one-off, positively contributed to the generation of this profit and maintain, in their respective segment or geographical area, a privileged stance as compared to their competitors in terms of income, efficiency, profitability and credit quality: Spain and Portugal contribute €2,373 million, WB&AM €1,011 million, Mexico €1,359 million, United States €21 million (excluding one-offs) and South America €871 million.

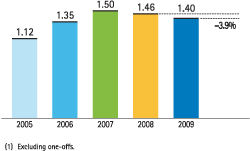

The basic earnings per share (EPS) were €1.12 in 2009, as compared to €1.35 in 2008. Excluding one-offs, the figure increases to €1.40 and maintains the similar levels as in 2008 (€1.46 per share) and in relatively stable amounts with respect to the level before the start of the crisis, while the majority of banks have seen their EPS suffer a significant drop in this period.

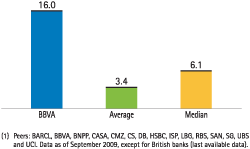

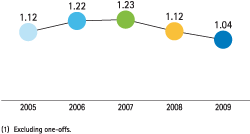

Likewise, the high profitability ratios achieved by BBVA in 2009 are particularly noteworthy, with a ROE excluding one-offs of 20.0% (16.0% with one-offs), a ROA of 1.04% (0.85% with one-offs) and a RORWA of 1.92% (1.56% with one-offs), with which the Group maintains its position as one of the most profitable in the system.

BBVA has distributed three interim dividends against 2009 earnings at a gross amount of €0.27 per share in cash, which has implied a payout of €1,012 million, against a background in which many entities have adjusted and even cancelled their cash remunerations. In addition, it proposes to the AGM the distribution of a final dividend of €0.15 per share, thus raising the total shareholderremuneration for 2009 to €0.42 per share, resulting in a 30% payout in cash over the net attributable profit excluding one-offs.