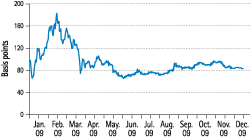

There were two clearly differentiated parts to 2009: in the first quarter, many financial institutions suffered difficulties in managing liquidity and associated risks as a result of the lack of confidence among many of the counterparties in the market. The credit spreads applied, both in the primary market (issuance) and in the secondary and derivatives markets (credit default swaps, CDS), reached their highest levels since the squeeze began in the summer of 2007. Subsequently, following the extraordinary measures adopted by governments and central banks to stabilize the financial system, these spreads began to narrow gradually. The chart BBVA Senior 5-year CDS shows the price of credit default swaps (CDS) on BBVA in 2009.

In this environment, the liquidity management policy followed in BBVA has been based, among other things, on anticipation and prudent control of the risk assumed, supported by a favorable market perception of BBVA’s relative strength. This has allowed the Entity to enter the wholesale market with long-term issues on a selective basis. In all cases, the Bank has financed itself, in accordance with its rating and capacity to generate recurrent results. It has never had to resort to public support or guarantees. Liquidity risk control in 2009 was also backed up by the maintenance of a sufficiently large buffer of liquid assets, fully available for discount, to cover the main shortterm commitments. This policy coincides with the regulatory proposal (in a consultation document) made by BIS in December 2009 for future implementation.

The issuance policy in 2009 has been selective and aimed at ensuring finance that was diversified by counterparties, instruments, terms, currencies and geographical areas. This has meant that there were no major tensions in the year for BBVA as far as liquidity is concerned, with moderate use of limits, minimal or no participation in the ordinary Central Bank auctions and stability in the main indicators of liquidity. The chart below shows the relative annual trend of one of the indicators used to monitor the liquidity position and its potential risk.

Among the highlights that demonstrate the confidence of retail and wholesale customers in the Bank has been the sale of €1,000 million euros of senior debt in January, the increase in attraction of liquid funds and the reopening of the market for mortgage-backed securities in October.

In BBVA, it is the Asset/Liability Management unit that is responsible for integral liquidity management. To do so, it takes account of a broad framework of limits, sublimits and alerts approved by the Executive Committee. These limits are independently measured and controlled by the Risk area, which at the same time offers managers the support tools and metrics they need to make their decisions.

BBVA’s model separates the management and liquidity control functions in different banks, in accordance with a corporate scheme of measurement, control and supervision. Using this model, corresponding daily and monthly analyses are carried out, as well as stress tests at least once a month. In addition, each entity has its own Contingency Plan to address possible situations of tension. The Plan defines the responsibilities of each area in the Group and the hierarchical committees that monitor and resolve possible liquidity tensions.