The Corporate Responsibility and Reputation (CRR) Strategic Plan was consolidated in 2009, with the focus on inclusion and financial education

The mission of the Group’s Corporate Responsibility (CR) is to strengthen the commitment to provide the maximum value possible to direct stakeholder groups (shareholders, customers, employees and suppliers) and to the society where the Group operates. This is based on maximum levels of integrity and transparency.

The main commitments the Group seeks to fulfill through its CR policy are as follows:

- Uphold excellence at all times in its core business operations.

- Minimize the negative impacts caused by its business activity.

- Create “social business opportunities” to generate both social and economic value for BBVA.

- Invest in those societies in which the Group is present through support for social projects, especially those involving education.

In 2009 there has been a consolidation of the Corporate Responsibility and Reputation (CRR) Strategic Plan, approved at the Board of Directors in May 2008. Throughout 2009 it has been directly monitored through the Board itself and the Executive Committee. This plan has defined a clear widely-ranging strategy with education and financial inclusion (banking penetration) as priority areas. The Global Financial Education Plan El dinero en nuestras vidas (The money in our lives) was launched in 2009 by BBVA as a way of using education for the responsible use of money in two areas: the processes of banking penetration in Latin America and education in skills and values associated with the use of money among the very young. This plan has also given BBVA the right structure to adapt corporate projects to local realities and to involve all the areas of the business. The CRR committee has thus continued to integrate CR criteria, activities and policies throughout the Group’s business and support areas. New local CRR committees have also been created in Spain and Portugal, Paraguay and Uruguay. In addition, there has been intense activity in those already in operation (Corporate, Mexico, Argentina, Colombia, Chile, Peru and Venezuela). All have been chaired by each country’s Country Manager and reflect the Group’s CRR model.

With regard to international commitments, BBVA continues to support the United Nations Global Compact, the Financial Initiative of the United Nations Environment Program (UNEP-FI) and the Equator Principles, and continues to publicly recognize its respect to the United Nations Declaration of Human Rights and the fundamental labor rights of the International Labor Organization. It is also worth highlighting the initiative in the area of Regulatory Compliance to participate in a high-level group of the United Nations Global Compact Anti-Corruption. Work has also been done to improve the information provided for all stakeholders. Mexico, Argentina, Colombia and Chile have already published their second report, and Peru and Venezuela have published their third. All these reports have been validated by an external auditor. Finally, within the CR department, a specific unit has been created to listen to stakeholders and discuss with them in order to integrate their expectations to the subjects that are really relevant to them.

The main challenge in 2009: the Global Financial Education Plan El dinero en nuestras vidas

The relevant matters are the basis on which the CR policy is developed. They have been identified through multiple channels of dialog and relationship with stakeholders to integrate on the one hand the vision, principles and strategies of the entity, and stakeholder expectations on the other. They were revised in 2008 to check their validity in a situation of crisis. The main advances made in 2009 were as follows:

Customer focus

- Presentation of the Corporate Complaints Report for the second year in a row, as the most useful initiative in improving customer relations through an efficient and structured process of transformation and improved management.

Financial inclusion

- Development and consolidation of the network of microfinance entities in the BBVA Microfinance Foundation in Colombia, Peru, Puerto Rico and Chile. At year-end, the Foundation had 229 branch offices and 2,791 employees, providing a service to more than 499,961 customers, which means a total figure of over two million beneficiaries.

- Extension of banking correspondent points of sale by 12,000 in Mexico. In addition, there has been an increase of 8% in non-branch alternative points of sale in Latin America (agents, express, banking correspondents, etc.).

Responsible finance

- Approval of the manual for the management of social and environmental risks in the Group’s credit activity, unifying procedures for compliance with the Equator Principles related to project financing. Local representatives for environmental and social risks have also been appointed.

- A total of 78 financing and advisory projects have been categorized according to the Equator Principles.

Responsible products and services

- Boost for socially responsible investment (SRI) through initiatives, such as the launch of BBVA Bancomer B+EDU (the first mutual fund with a commitment to education) and the certification of the entire employee pension plans in Spain, according to sustainability criteria. In 2009, the percentage of SRI funds out of all managed funds was 2.92%.

- The signature by BBVA and the Inter-American Development Bank (IDB) of a framework agreement to increase cooperation between both institutions in areas such as the provision of financial and non-financial services for micro, small and medium-sized enterprises; advice on energy efficiency; global trade finance; co-finance of infrastructure and financial education projects.

Responsible management of human resources

- Launch of the Apúntate (Enroll) tool in Spain, Argentina, Mexico and Colombia to reinforce transparency in the recruitment process.

- Development of numerous initiatives related to diversity and equality: joining the Catalyst network, signature of the Charter for Diversity in Spain and obtaining the certificate for MEGA gender equality companies in Argentina.

Responsible procurement

- Definition of the Group’s Global Procurement Model, valid for all the countries in which BBVA is present.

- Preparation of the financial platform in Mexico to improve the process of reception, acceptance and payment of supplier invoices.

- Satisfaction survey for suppliers in Mexico, Argentina, Chile, Colombia, Peru and Venezuela.

Environmental management and climate change

- Achievement of the targets of the Global Eco-Efficiency Plan 2009-2012, with a reduction of 3.2% in CO2 emissions, 2.4% in paper consumption, 1.1% in water consumption and 0.3% in electricity consumption (all figures per employee). In addition, there has been an increase of 14.8% in the percentage of employees working in buildings with ISO-14001 certifications. The new head offices in Paraguay have also received the LEED certification, granted to constructions that use criteria of sustainability; and the Mexican head offices are currently in the process of receiving the same certification.

- Signatory to the Copenhagen Communiqué on Climate Change, together with more than 500 leading companies.

Community involvement

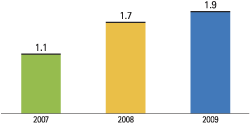

In 2009 the Group has spent more than 79 million euros on its community involvement, a year-on-year increase of 1.9% on the net attributable profit.

The following are of particular interest:

- Launch of the Global Financial Education Plan El dinero en nuestras vidas (The Money in Our Lives), linked to the CRR Plan and with a budget of 26 million euros. This is a three-year plan (2009-2011) implemented in all the geographical areas in which the Group is present, with specific programs for different groups. In its first year it will have 440,000 direct beneficiaries.

- Consolidation of the Corporate Volunteer Program.

- Reinforcement of the Community Investment Plan for Latin America, with the allocation, in 2009, of a budget of 1% of the profits obtained by the Group in 2008 in each country in which it operates. The star program in this plan is that of the Niños Adelante (Children Forward) integration scholarships.

Finally, BBVA maintains its privileged position in analyst portfolios and sustainability indices. These indices measure the performance of companies from the point of view of corporate governance, community, ethical and environmental respects, and make it eligible in terms of responsible investment. Its continued presence in these indices demands a demonstration of constant progress in this respect.

Main sustainability indices featuring BBVA

|

|

|

Weighting (%) |

|---|---|---|

|

DJSI World | 0.80 |

| DJSI STOXX | 1.85 | |

| DJSI EURO STOXX | 3.60 | |

|

ASPI Eurozone Index | 2.60 |

| Ethibel Sustainability Index Excellence Europe | 2.13 | |

| Ethibel Sustainability Index Excellence Global | 1.30 | |

|

FTSE KLD Global Sustainability Index | 0.71 |

| FTSE KLD Global Sustainability Index Ex-US | 1.23 | |

| FTSE KLD Europe Sustainability Index | 2.08 | |

| FTSE KLD Europe Asia Pacific Sustainability Index: | 1.41 |

For more information about specific schemes, as well as a scorecard of progress in 2009 and goals for 2010, see the Annual Corporate Responsibility Report 2009, which will be published in May this year and be available online at http://rrc.bbva.com.