Two major phenomena characterized 2009 in the business of pensions in the Americas. First, there was the natural growth of the contributions from affiliates, which consolidated and increased the growth in managed funds; and second, there was the rising trend of the equity markets, in which the pension funds invest a substantial proportion of their assets.

The risk associated with regulatory framework, which is proportional to the volume of managed funds, increases in line with the managed funds and this can be seen in the economic capital assigned to the activity, which increased by 15.7% on the figure for 2008 to €397 million euros.

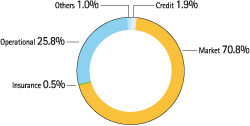

Market risk is by far the most important and represents 70.8% of total economic capital, slightly more than in the previous year. It is followed by operational risk, which accounts for 25.8%, similar to the 2008 figure.