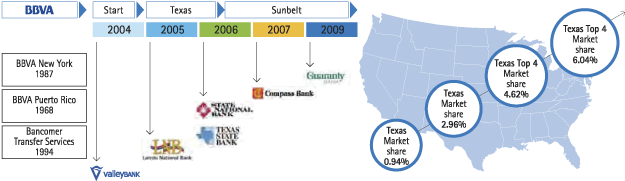

The United States

In 2009, the area focused on:

- Finishing the implementation of the new BBVA Compass brand, serving to combine local recognition and international prestige.

- Organizational transformation, a process that has been complemented with the integration of Compass in BBVA’s universal banking model and with the legal incorporation of BBVA Bancomer USA in Compass.

- Increasing efficiency and productivity, with a significant reduction of costs (down 6.7% year-on-year) and streamlining of structures.

- Improving asset quality through:

- A detailed analysis of the commercial real estate loan book, which has led the Group to make substantial efforts in loan-loss provisioning.

- The increased weight of low-risk portfolios, such as residential mortgages.

Guaranty’s incorporation has contributed to the expansion strategy in the Sunbelt in 2009.

Plans for 2010 include finalizing the operative integration of Guaranty. The focus will also be on:

- The Transformation Plan, consisting of the transition to BBVA’s retail banking model. BBVA Compass will have the opportunity to play a priority role in the transformation of the financial industry in the United States. Changes in customer preferences and new technologies will offer new opportunities and pose new challenges for the country’s banking industry. In order for BBVA Compass to position itself as a leader, it must anticipate changes in the industry and take advantage of its, and the Group’s, competitive advantages in the development of the new customer relations model.

- Deepened customer knowledge: the basis of the brand’s philosophy in the country, Solutions Built Around You. This model begins with a customer study to verify how banking products are consumed before developing new products and services. It encompasses a comprehensive view of the customers and their experiences with BBVA Compass, which will require simultaneous action in products, marketing, channels and sales procedures. Boosting innovation and a differentiated product offer are expected to increase brand recognition, improve the customer experience and consolidate its footprint.

- Product innovation, taking advantage of the Group’s experience. As in 2009, BBVA Compass will continue with the launch of value added products that adapt to the needs of its customers.

- The development of multi-channel banking, as one of the pillars of building customer relationships, will provide customers with different alternatives for interacting with BBVA Compass, with three main objectives: quickness of response, ease of use and customization to client needs. In 2010, it will also continue improving other channels, such as: branches, call centers, state-of-the-art ATMs, mobile banking (the US banking system is the first to have a specific application for iPhone and iTouch), online banking, platforms for integrating the “physical” and “virtual” worlds, etc.