The economic downturn has led to a slower growth in banking business volumes throughout the Mexican banking system. Despite this, BBVA Bancomer has managed to grow its franchise and enhance its reputation by the positive results it achieved in both lending and customer funds. Its outstanding performance amid this complicated global economic and financial backdrop was recognized by Euromoney, who named BBVA Bancomer Best Bank in Mexico.

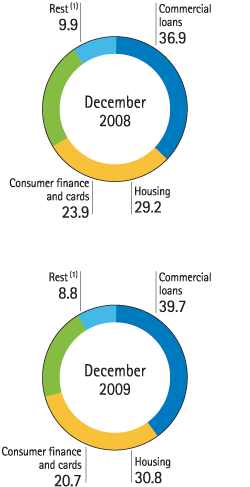

Gross customer lending reached €28,996m at the end of 2009. Although this was 0.4% lower than the previous year, it left Bancomer’s leadership intact. The loan book gradually changed its composition over the year. The percentage of consumer credit and card business shrank as lower risk products grew their share of the total. The year-end figures show a diversified structure: 39.7% of the lending was in the commercial book (which includes loans to large corporations, small and medium-sized enterprises, financial institutions and the Government); 30.8% in the housing book (including developers and excluding the old mortgage portfolio) and 20.7% in the consumer finance book.

The commercial loan book grew 7.1% year-on-year. The fastest growth came from lending to SMEs, which went up 21.7% year-on-year to €968m. BBVA Bancomer has developed a specialized network to service this segment, which had more than 300,000 customers at year-end 2009. A program (Programa de Liquidez PYME) was launched to boost liquidity in SMEs, and more than 8,000 SMEs have been beneficiaries of it during the financial crisis. Also noteworthy is the 51.2% increase over 2008 in lending to government bodies. The boost of lending to large corporations through bilateral loans and the placement of bonds and syndicated loans in the local market has been maintained. This has had the effect of reinforcing BBVA Bancomer’s leadership position in placement of bonds, with a 20.6% market share, and syndicated loans, with a 17.7% share, according to data from Bloomberg and Thomson Financial, respectively, in December 2009.

In October, BBVA Bancomer received a national prize, Premio Nacional de Vivienda 2008, for the second consecutive time, for launching six new mortgage products in the market for lending to home buyers. These products included: loans for home improvements, remodeling or additions to homes and financial discount, which provides liquidity to construction companies. At year end, the mortgage loan book (excluding the old mortgage portfolio) had grown 7.0% year-on-year. According to the latest figures, BBVA Bancomer still has the largest volume of new mortgages, with more than 36,000 loans for individual customers and more than 73,000 for developers. BBVA Bancomer was also named by Nacional Financiera (the government development bank) as The most outstanding financial intermediary in 2009, for its SME-support program and its mortgage product for households facing economic difficulties.

Consumer credit continued to shrink against the previous year, down 13.6%, reflecting both the economic downturn and the Bank’s strict risk acceptance policy. Much of the drop was due to lower credit card lending. However, over the last two months of the year, credit cards performed better, helped by the brighter environment and various campaigns to encourage proper use of credit. A more suitable use of credit cards was reflected in the stabilization of the NPA ratio on this loan book.

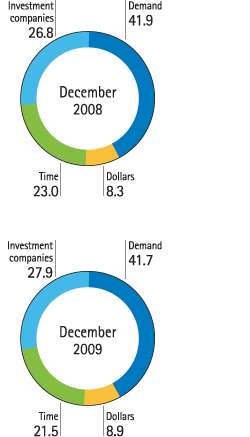

The balance of customer funds (bank deposits, repos, funds and investment companies) reached €44,579m in December 2009. This was a year-on-year increase of 5.2%. This positive performance was largely due to the launch of innovative products and a stronger distribution network. In this regard, at year-end 2009, BBVA Bancomer had more than 6,200 ATMs, 423 more than in 2008. Additionally BBVA Bancomer has been authorized to operate banking correspondents which will enable it to increase by more than 12,000 the points of sale over 2010. These commercial establishments could perform (current estimate) around 40 million banking transactions, thus reinforcing the current network. Apart from this, a new kind of ATM has been activated (practicajas) to allow customers to place deposits, make transfers, pay for credit cards and services and request loans. By expediting teller processes, these have improved customer service.

At December 31, 2009, the composition of customer funds had barely changed from the same time the previous year. Lower cost products (current and savings) bear the greatest weight, reaching 41.7% of the total; investment companies have 27.9% and time deposits closed at 21.5%. The rest corresponds to foreign currency, primarily dollars (8.9%). Off-balance-sheet customer funds reflected the dynamic performance of investment companies. These grew at 13.0% year-on-year.

Finally, BBVA Bancomer has continued to actively manage its liquidity and its capital adequacy by making issues on the local market. During 2009, it was the top private mortgage covered bonds issuer and launched the biggest issue in the Mexican market for a total of €312m. In order to maintain adequate capital ratios, it issued €157m in subordinated debt, thereby improving the bank’s capital ratio by 123 basis points.

The development of BBVA Bancomer’s own management style and its effort to create leaders have been recognized in the fourth quarter by Hewitt Associated who ranked BBVA Bancomer among its Top companies for Leaders 2009.