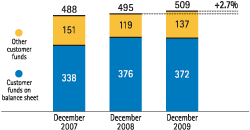

As of December 31, 2009, total customer funds on and off the balance sheet came to €509 billion, an increase of 2.7% compared to the €495 billion a year earlier.

Customer funds on the balance sheet were €372 billion as of December 31, 2009, a fall of 1.2% on the figure of €376 billion at the close of 2008. This fall is basically the result of the reduction in term deposits, partly due to customer preference for other products and partly due to BBVA’s comfortable liquidity position. As usual in recent years customer funds on the balance sheet are greater than gross lending and this highlights the Group’s positive liquidity position.

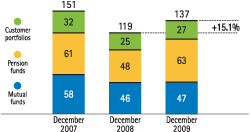

As of December 31, 2009, customer funds off the balance sheet (mutual funds, pension funds and customer portfolios) came to €137 billion, a rise of 15.1% compared with €119 billion a year earlier. The improvement reflects the gathering of funds (especially pension funds) and the rise in equity markets towards the end of the year, which boosted assets under management and customer portfolios.

In Spain the sharp decline in interest rates caused customers to switch from time deposits to current accounts and more conservative types of mutual funds. In addition, the Group’s comfortable liquidity situation meant it could focus on defending spreads, as fund gathering has not been a commercial priority. Thus time deposits fell by 19.8% year-on-year to €35 billion euros at the close of December 2009. Current and savings accounts grew by 6.3% over the year to €47 billion as of December 31, 2009. Mutual funds fell by 6.0% year-on-year to €33 billion. This fall is lower than that in the system as a whole, so BBVA maintains its leading position as the biggest mutual fund manager in Spain, with a market share of 19.3% as of December 31, 2009. Pension funds performed well and increased to €17 billion, 6.9% above the figure twelve months previously. This has allowed BBVA to consolidate its leading position in Spain in this sector, with a market share of 18.6% at year end. Of the total managed assets in pension funds, €10 billion corresponded to individual plans and €7 billion to employee and associate schemes. The Group continues to be a leader in both categories, with market shares of 16.5% and 22.7% respectively. Customer portfolios also showed significant growth (22.8%).

In terms of non-resident customer funds, the aggregate of items on and off the balance sheet increased 11.0% during the year to €231 billion. The rise reflects the excellent performance of off-balance-sheet funds, which increased 28.8% in 2009 thanks to positive contributions from the pension business in the South America and Mexico areas. Customer funds on the balance sheet rose 4.3% year-onyear. This was mainly due to an increase in items with greater margins and lower costs, e.g. current and savings accounts, which increased 11.9% over the year.