Wholesale Banking & Asset Management

This unit handles the origination, structuring, distribution and risk management of market products, which are placed through the trading floors in Europe, Asia and the Americas.

Global Markets has successfully:

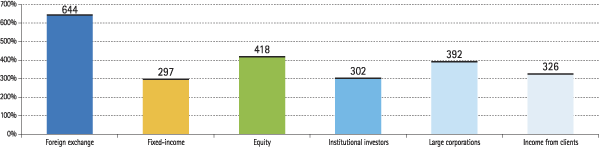

- Taken advantage of market opportunities in a complicated 2009. In terms of customers, business with institutional investors is again growing and the corporate segment is buoyant. The unit successfully concluded a series of proprietary trading opportunities in the first half, especially with interest-rates. In the day-to-day business, there was an extraordinary recovery of the credit business on all trading floors and fixed-income related to customers’ risk hedging.

- Earned the leadership position in equity brokerage in the stock market in Spain with a market share of 15.0% in December 2009. The second-ranked competitor has a market share of less than 10.4%.

- Become a leader in product innovation in Latin America, with the launch of a new exchange-traded fund (ETF) called MEXTRAC on the Mexican stock exchange. Its portfolio is made up of the 20 stocks on the Dow Jones Mexico Titans index.

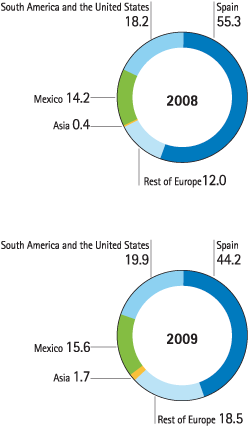

- Transformed into an increasingly international and geographically-diversified business. This is reflected by the double-digit growth at all the trading floors in Europe, Asia, Mexico and South America. In addition cross-border business continues to improve thanks to the global nature of the products and customer service, and to the close cooperation between teams.

- Achieved record earnings and efficiency. Gross income for the year in Europe, Asia and New York was up 22.9% to €654m, operating income rose 36.3% to €427m and net attributable profit jumped 146.6% to €318m. These figures are the result of a superb year at Global Markets, recurrent earnings despite the difficult environment and proper cost controls. These achievements led to an improvement in the cost/income ratio, which now stands at 34.8%, notably lower than 2008 (41.1%), making the unit one of the most efficient in the whole industry.

- Consolidated its position in Asia, a market that has recorded high growth in commercial activity, with triple digit growth in underlying assets and in customer segments, as indicated in the chart enclosed: