Exposure at default (EAD) is another of the inputs required to calculate expected loss and capital. It is defined as the outstanding debt pending payment at the time of default.

A contract’s exposure usually coincides with its outstanding balance, although this is not always the case. For example, for products with explicit limits, such as credit cards or credit lines, exposure should include the potential increase in the balance from a reference date to the time of default.

The EAD is obtained by adding the risk already drawn on the operation to a percentage of undrawn risk. This percentage is calculated using the CCF which is defined as the percentage of the undrawn balance that is expected to be used before default occurs. Thus the EAD is estimated by calculating this conversion factor using statistical analysis.

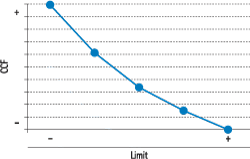

The estimate of these conversion factors also includes distinguishing factors that depend on the characteristics of the transaction: for example, in the case of credit lines awarded by BBVA Spain, the conversion factor is estimated according to the limit of the line.

In order to obtain CCF estimations for low-default portfolios, external studies and internal data are combined, or behavior similar to other portfolios is assumed and they are assigned the same CCF values.