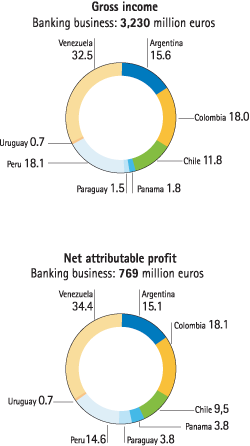

The area’s banking business generated a net attributable profit of €769m in 2009, for a year-on-year increase of 13.1%.

Argentina

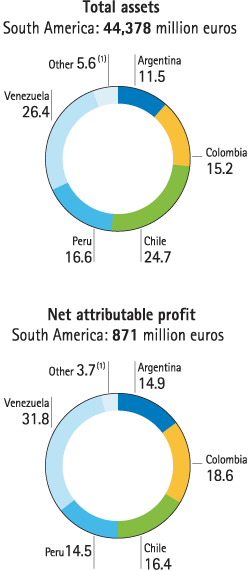

In the first two quarters of 2009, the Argentine economy suffered a significant slowdown due to the impact of the international financial crisis on income from the foreign sector and conflicts within the agriculture sector. Implementing countercyclical measures and a less restrictive monetary policy made room for the first signs of recovery in the second half of the year, which was also helped by heightened commodity prices.

In 2009, BBVA Banco Francés continued concentrating on expanding its lending activity in all business segments. It placed a special emphasis on retail, which has recorded greatest growth, especially in credit cards. Asset quality was also strong, and the NPA rate for the entity at the end of December, 1.1%, compares very favorably with the rest of the Argentine financial system. The strategy of prioritizing the capture of transactional deposits was maintained in customer funds, which were up 11.9% year-on-year, and a low-cost funds structure and 10.4% progress in current and savings accounts were achieved.

In 2009, the entity produced €116m in net attributable profit, with excellent net interest income and net fees and commissions income growth (up 24.8% and 27.8%, respectively) which has translated into significant improvement in its profitability indices. Moderation of costs, which grew at a lower rate than inflation in the country, pushed operating income up 27.2% over the year, although the normalized tax rate marred its contribution to the bottom line. It was ranked best bank in Argentina by Euromoney in 2009.

Chile

The Chilean economy shrunk 1.8% in 2009, primarily because the international crisis produced a drop in inventories and fixed capital expenditures, together with a severe contraction of internal demand. This has also resulted in a negative inflation rate for the year. Countercyclical monetary measures applied by the Central Bank of Chile and an expansive fiscal policy have allowed the economy to revert after the third quarter.

In this regard, BBVA Chile maintained its strategy of repositioning in the retail business. The Top One and Top Sales plans were finalized in 2009, and implied a redefinition of commercial networks, with segmentation in the value offer, greater marketing dynamics and externalization of operative servicing. Fruits of these efforts have included: an increase in commercial productivity (up 60%), transactions into alternative channels (up 30%) and consumer credit (up 13.8%) with an increase in market share of 53 basis points according to data from November. The focus in customer funds has been on current accounts and mutual funds. These also experienced market share increases of 39 and 86 basis points, respectively, according to data from November. Forum has also consolidated its leadership position in the auto finance segment with an increase of its share in new car loans to 150 basis points in 2009.

BBVA Chile and Forum have generated a joint net attributable profit of €73 million in 2009 (up 18.7%). The key to doing so was spread management, which has offset the impact of the fall in interest rates and inflation and allowed for 20.9% growth in the gross income and 32.1% of the operating income. In 2009, BBVA Chile was granted the National Prize for Quality by the Ministry of Economy; the Bicentennial Seal by the Office of the Prime Minister for the social responsibility program Niños Adelante; and the Latin American Award for Quality from the Fundación Iberoamericana para la Gestión de la Calidad (Latin American Foundation for Quality Management) given to the top company in Latin America.

Colombia

The year 2009 was quite difficult for the Colombian economy as a result of the complicated international environment. However, the launch of an expansive monetary policy and the increase of public spending on civil works have helped the nation to overcome the situation. Direct foreign investment flows and access to the capital markets were maintained, despite the liquidity tensions globally.

Against this backdrop, BBVA Colombia developed several initiatives to improve their service and position in the market in 2009, with the expansion of their commercial and ATMs networks. Several consumer finance initiatives were implemented in the individual segment, and the credit card section launched the Mujer BBVA (BBVA Woman) and Mastercard Black BBVA cards for VIP clients. Positive development was also observed in the mortgage segment, with a year-on-year increase in market share of 54 basis points, according to data in November. The SME segment strengthened business and was an active presence in several business forums and seminars. Regarding customer funds, it was also a good year for capture of transactional deposits, with an increase in the market share for current and savings accounts. Ordinary Bonds indexed to term deposits rate (DTF) and inflation rate (CPI) were successfully placed in August, for a total of 198,000 million pesos.

In this complicated year, the entity produced a net attributable profit of €139 million (up 8.7%), with an operating income reaching €365 million (13.2% more than in 2008) and an efficiency ratio that improved from 40.4% in 2008 to 37.2%. In 2009, BBVA Colombia was recognized as the top Colombian bank in sustainability by Latin Finance magazine and the Management & Excellence consulting firm. BBVA Colombia was also Euromoney’s top choice in Cash Management services.

Panama

Once the liquidity tensions were overcome in the first half of the year and the electoral process was Loans Deposits Pensions Business share ranking in the countries of South America in 2009 finalized, the Panamanian economy faced successfully the internationally crisis in 2009, specially in the second half of the year.

BBVA Panama closed the year positively with advances in lending and deposits. Moreover, it issued its first corporate bonds in May, with an initial series of 25 million dollars. The NPA ratio has remained at a much lower level than the rest of the system.

The net attributable profit produced by BBVA Panama stands at €29 million, with solid performance in sources of revenue and a very moderate advance in expenses.

Paraguay

The Paraguayan economy was affected by both the economic crisis in 2009 and the effect of the drought on the agriculture sector. The recently announced Economic Reactivation Plan is expected to put the country back on the path to growth as in previous years.

In the midst of strong competition, BBVA Paraguay has reported year-on-year growth of lending of 13.3%, thanks to the retail business with consumer loans. In turn, customer funds have increased 20.8%. Excellent risk management has allowed NPA ratios to be kept at a minimum (1.2%), which is significantly lower than the mean for the sector. The Bank opened two new branches this year and equipped its first customer service center in 2009, in addition to increasing its number of ATMs and completing construction on the new headquarters.

In 2009, the bank’s net attributable profit was at €29 million, up 27.4% from the year before, with significant advances in all sources of income. The entity was recognized for the third consecutive year as the best bank in Paraguay by The Banker and Euromoney.

Peru

The effects of the economic crisis on the Peruvian economy are reflected in the lower levels of private investment and a decrease in exports. However, Peru has been one of the few countries in the region to report GDP growth in 2009, due to fiscal and monetary stimuli policies.

BBVA Banco Continental has maintained its business expansion strategy in 2009. In the individual segment, new personal loan products (Préstamo 60) were marketed and credit cards have encouraged customer loyalty. The bank also launched the Cuenta Ganadora (Winners account) in the customer funds area. In order to improve customer service quality, the number of ATMs was increased by 36%. In transactional services, the launch of the E-mpresario.com site was granted the business creativity award for customer service. Within the Corporate and Investment Banking unit, derivatives sales to corporate clients were boosted.

The bank generated an attributable profit of €112 million in 2009. This was up 27.0% year-on-year, due to the significant growth the operating income €412 million, up 19.8% more than in 2008. This growth is based on the solid performance of the net interest income (up 23.0%) and in other sources of income, as well as in the moderation of costs. Efficiency has improved to 29.5% (31.6% in 2008). The entity was recognized as the best bank in Peru by Global Finance (for the sixth consecutive year), Latin Finance and América Economía. It was also named Best Internet Consumer Bank and received an honorable mention in the Great Place to Work ranking. Furthermore, it was selected as one of the four best banks in the region by Poder magazine, and was given an A+ by Global Reporting Initiative (GRI).

Uruguay

The Uruguayan economy was greatly affected by the international financial crisis in 2009, and especially by the contraction of world trade. However, the solid foundation of the local economy prevented significant GDP deterioration.

In 2009, BBVA Uruguay carried out several actions to improve the quality of customer service it offers. These efforts included the servicing plan in branches, the installation of self-service terminals, improvement of the BBVANet platform and the implementation of the Plan Crecer Comercio Exterior (foreign trade program). Consumer finance, credit cards and mortgages were strengthened in the individual segment under the Banking Penetration Plan. Business with SMEs also grew through the Plan Crecer Empresas (SME program).

In a very complicated year, the bank generated an attributable profit of €5 million.

Venezuela

In the first part of 2009, the Venezuelan economy showed clear signs of recession and inflationary pressures, due to the fall in oil prices, decreased volume of currencies liquidated on the official FX market and the contraction of the central government’s spending. In order to stimulate demand, the monetary policy was adjusted by reducing the cost of financing and enabling the absorption of the debt program in the public sector. Economic conditions appeared to recover somewhat in the fourth quarter, in line with the rise in oil prices.

In 2009, BBVA Banco Provincial maintained its strategic objective of transformation and growth, and concentrated on the modernization of the branch network, increased weight of alternative channels and improved service quality. Thus, self-service spaces were created in the branches, the capacity of multi-function ATMs was increased and online and telephone banking were equipped with programming to be able to submit complaints. The loan portfolio has increased 17.7%, despite the slowdown of economic activity, and the entity has maintained its leadership position in the consumer finance segment. Customer funds recorded a 19.7% year-on-year increase due to the strategy of prioritizing the capture of transactional deposits (up 24.4%).

As a result, the net attributable profit came to €265 million (up 22.6%). The keys included: successful management of rates which, together with the positive rise in business volumes increased net interest income by 24.8% over the year. Contention of costs, which grow at a rate of 20.4% (below inflation rates for the country) favored the strong efficiency ratio (39.8%) and the increase of the operating income (up 10.9%) to €632 million. The bank was awarded several prizes in 2009, including Best Bank in Venezuela by Global Finance, Euromoney and Latin Finance. The Banker named it the Most Innovative Bank in Information Security.

Pensions and insurance

In 2009, the Pensions & Insurance unit contributed a net attributable profit of €135m, more than doubling its 2008 figure. Of this, €88m were generated by the pension fund business and €46m by the insurance business.

Pensions

The pension fund business also had a very positive year due to the recovery of financial markets and the solid performance of income from fees and commissions and cost austerity. The assets under management ended the year 27.6% up on 2008. Fund gathering growth in 2009 was 5.9% higher than in 2008, excluding the effect of the Consolidar AFJP divestment, despite the scarce progress of employment in the region. BBVA has consolidated its position as a world leader in private pension systems, thanks to its collaboration agreements with the IDB and the OECD.

In 2009, AFP Provida in Chile generated a net attributable profit of €61 million, as compared to the €7 million in 2008. Assets under management reached €24,552 million as at December 31, 2009 (up 26.1%). Likewise, AFP Horizonte in Colombia increased its AuM by 31.8% in 2009, and its number of pension-savers by 6.6%, for a net attributable profit of €18 million (€4 million in 2008). AFP Horizonte in Peru achieved a net attributable profit of €14 million (€2 million in 2008), in a context marked by dynamic business activity, with increases in revenues (up 3.8%), number of affiliates (up 5.1%) and assets under management (up 40.3%).

Insurance

BBVA’s insurance franchise business model has continued to consolidate in 2009, and has extended its range of products and opened new channels for distribution and sales. However, banking networks continue to be the driving force for business, as new business lines have been opened to meet special needs (Plan Empresas, Pymes y Comercios - SME and retail programs). This has resulted in a 7.2% increase in income and a volume of premiums underwritten totaling €462 million, together with the moderate increase in claims and expenses. Therefore, the net attributable profit of the group of companies stands at €46 million, €20 million of which correspond to Grupo Consolidar in Argentina, €12 million to Seguros Venezuela, €9 million to Chilean companies and €5 million to Colombian companies.