Central banks maintained expansive monetary policies in the first half of 2009, with significant interest-rate cuts and downward pressure on the curves of the main markets in which BBVA carries out its banking activity. Particularly notable were the falls in Mexico, South America and Europe, where, in addition, there was a gradual upward steepening shift in the yield curve between the 3- month and 1-year rate.

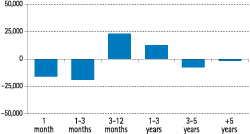

The variations in market interest rates have an effect on the Group’s net interest income, from a medium and short-term perspective, and on its economic value, if a long-term view is adopted. The main source of risk resides in the time mismatch that exists between repricing and maturity dates of the different products comprising the banking book. This is illustrated by the attached chart, which shows the gap analysis of BBVA’s structural balance sheet in euros.

The major falls in interest rates in the first quarters of the year had a positive effect on the net interest income of the Group. The subsequent consolidation of rates at low levels against a background of slowdown in volumes of activity makes up the scenario of the banking book throughout 2009. Its interest-rate risk has been managed proactively by the Assets and Liabilities Management unit which, through the Asset and Liabilities Committee (ALCO) develops management strategies designed to maximize the economic value of the banking book and preserving the recurring results through net interest income. To do so, it not only takes market outlook into onsideration, but it also ensures that exposure levels match the risk profile defined by the Group’s management bodies and that a balance is maintained between expected earnings and the risk level borne. The implementation of a transfer pricing policy that centralizes the Bank’s interest rate risk on ALCO’s books is helping to assure that balance-sheet risk is being properly managed.

Structural interest-rate risk control and monitoring is performed in the Risk area, which, acting as an independent unit, guarantees that the risk management and control functions are conveniently segregated. This policy is in line with the Basel Committee on Banking Supervision recommendations. The area’s functions include designing models and measurement systems, together with the development of monitoring, reporting and control policies. The Risk area performs monthly measurements of structural interest rate risk, thus supporting the management of the Group. It also performs risk control and analysis, which is then reported to the main governing bodies, such as the Executive Committee and the Board of Director’s Risk Committee.

The Group’s structural interest-rate risk measurement model uses a set of metrics and tools that enable its risk profile to be identified and assessed. From the perspective of characterizing the balance sheet, analytical models have been developed to establish assumptions dealing fundamentally with prepayment of loans and the run-off of deposits with no explicit maturity. A model for simulating interest rate curves is also applied to enable risk to be quantified in terms of probabilities. It allows sources of risk to be addressed in addition to the mismatching of cash flows coming not only from parallel movements but also from changes in the slope and curvature. This simulation model, which also considers the diversification between currencies and business units, calculates the earnings at risk (EaR) and economic capital (EC) as the maximum adverse deviations in net interest income and economic profit, respectively, for a particular confidence level and time horizon. These negative impacts are controlled in each of the Group’s entities through a limits policy.

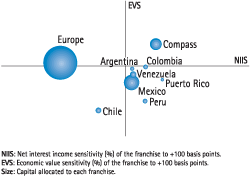

The risk measurement model is supplemented by scenario analyses and stress tests, as well as sensitivity measurements to a standard deviation of 100 basis points for all the market yield curves. The attached chart shows the structural interestrate profile of the Group’s main entities according to their sensitivities.

In 2009 emphasis continued to be placed on stress testing and scenario analysis to judge the results of a possible upward cycle, with high levels of uncertainty in terms of its size and when it would start, which could break the consolidation of interest rates at minimum historical levels. At the same time, foreseeable scenarios continued to be evaluated by the Research Department, together with other severe risk scenarios drawn up from an analysis of historical data and the breakdown of certain observed correlations. A more disaggregated analysis of the contribution to risk by portfolios, factors and regions, with their subsequent integration into joint measurements, represents another of the points on which special emphasis has been placed over the year.

The limits structure is one of the mainstays in control policies, because it represents BBVA’s risk appetite as defined by the Executive Committee. Balance-sheet management has enabled risk levels to be maintained in keeping with the Group’s risk profile, as is demonstrated in the following chart, which shows average limits use in each entity during 2009.