BBVA’s business strength

Against the backdrop of the economic crisis over recent years, BBVA has shown excellent behaviour by maintaining its sustained trajectory of earnings. This positive growth has its roots in the strength of its business model, characterized by:

- Focusing on core businesses, and within them, maintaining a greater weight of recurrent business.

- Encouraging a long-term vision and building mutually-beneficial, trust-based relationships with clients. This, of course, requires a culture of solid ethical principles.

- Prudently managing the Bank’s balance, primarily based on stable retail financing with a low leverage ratio.

- Maintaining a favorable level of geographical, business and client segment diversification.

- Committing to constantly reducing costs and, therefore, improving efficiency.

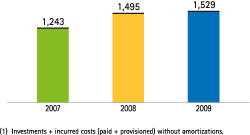

- Making a significant effort regarding technology which, in these times of crisis, has not only maintained its level but has even accelerated, by prioritizing those projects that will carry the Bank into the future.

All these characteristics make the BBVA business model sustainable and proven to be strong, one that allows for recurring profit in any setting, thanks to its capacity for anticipation. And it is this very capacity for anticipation that prepares the Group to compete in this new environment. Specifically, BBVA is already anticipating and making headway on:

- Regulatory changes in the industry.

- Changes in macroeconomic growth.

- Social changes that will completely transform the sector.

Regulatory changes

BBVA is in an ideal position to face the foreseeable regulatory changes:

- In capital, the trend is toward greater demands, with leverage limits and more restrictive requirements for trading activities. The BBVA business model places special emphasis on retail activity and has the lowest leverage ratio in the industry.

- In liquidity, the trend is toward a demand for retail funding and liquid assets, and BBVA already has this scheme in place, in addition to a clear decentralized management system for its subsidiaries.

- Regarding procyclicality, accounting standards are working towards mitigating its effect. BBVA already has a provisioning model based on expected loss in place.

- Finally, as regards systemic risk, the effect of contagion and the complexity of transnational relations within each bank are cause for worry, as structures for subsidiaries that limit these effects are taking precedence; this is precisely the model in place at BBVA.

Changes in macroeconomic growth

Moreover, BBVA is placing special emphasis on the regions with the highest growth profile by anticipating the most distinctive trends among regions which, therefore, demand different strategies.

- In Mexico, BBVA is the clear front-runner in a country with great potential for recovery and growth.

- In the United States, a large growth platform is being consolidated in a region of increased dynamism, especially in Texas, where BBVA is the fourth bank.

- In South America, geographical region with high growth, has significantly increased its contribution to the Group’s earnings.

- InAsia, another high-growth zone, presence in those hubs where BBVA is already present is on the rise, with greater capacity for assuming risks. Evidence of this is the aforementioned 5% increase in investment in CNCB and the commissioning of new business with the Bank’s associates, specifically the creation of two joint ventures, in auto financing and private banking.

- And in Spain, against an unstable backdrop, opportunities for growth in its quota are arising through commercial activities focused on specific segments and locations.

Social changes that will completely transform the sector

BBVA continues to anticipate the social changes that will impact 21st century banking. The horizon which we now face is characterized by:

- New client demands: more convenient and personalized services, in addition to greater transparency and ethical behavior.

- New facilities provided through new technology that allow for the development of new concepts, ideas and business models, and to transform information into knowledge.

The above modify the form of “banking consumption” and accelerate the necessary reconversion of the sector: clients are looking for new types of relationships with the entity and demand new and improved products.

BBVA anticipated this scenario quite some time ago, and, therefore, has the ability to succeed. BBVA is evolving towards a business model that is:

- Well leveraged on technology, with very low unit costs in an increasingly competitive sector, being efficient with expenses and income, while broadening the sphere of relationships with clients.

- And that has a great capacity to manage, meaning having an excellent human team in place with more people focused on added-value tasks thanks to the use of technology.

These two pillars will allow BBVA to offer clients (people) differentiating solutions:

- Improved services: easier, faster and simpler.

- Broader range of services (not only financial).

- And more accessible services, to reach a greater number of clients.

All these solutions will be offered to clients through the new relationship model, a platform that will integrate the “physical” and “virtual” worlds.