The South America area manages the BBVA Group’s banking, pension and insurance businesses in the region.

The international financial crisis had a less negative effect on Latin America than expected, and clear signs of economic recovery were observed in the second quarter. Unlike previous crises, on this occasion the vast majority of countries in the region have adopted a significant expansive bias in their economic policies without provoking imbalances that would put this recovery in danger. Increasingly sound public finances, controlled inflation, the credibility that central banks have gained and the greater flexibility of the forex markets have been fundamental factors in the region’s improved performance. Stronger commodity prices and lower risk aversion have also contributed to the recovery. The rise in commodity prices took some pressure off the countries with most limited access to international credit, such as Argentina and Venezuela. The financial systems in the region showed enormous strength. They were able to weather the tight access to international funding at the end of 2008. They appeared unscathed by the decrease in the dynamism of activity and the increase in NPA ratios at the beginning of the year, which were anyway not as intense as elsewhere in the world or as in other crises.

There were no significant differences in exchange rates in the last part of the year, as compared to the US dollar. In comparison with the annual evolution of the euro, there was a slightly negative exchange-rate effect on the income statement and a positive effect on the balance sheet transactions and activity. As usual, the attached tables include columns with the year-on-year changes at constant exchange rates, which is what the following comments refer to. The sale of the Group’s stake in the insurance company Consolidar Salud and the nationalization of the pension fund business in Argentina in the fourth quarter of 2008 must be taken into account when analyzing year-on-year variations.

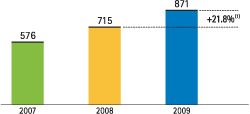

During a difficult year, the area performed well. There was a significant growth in revenues; costs were gradually moderated and a comfortable level of asset quality was maintained. All this fed into an €871m net attributable profit in 2009. This was up 21.8% year-on-year, sustaining a high level of return on equity (ROE): 40.2%.

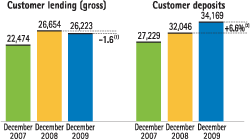

This excellent performance of income has been due to the correct pricing policy and the improved spreads applied, which are fundamental factors to offset the slight decrease in credit activity which ended December down 1.6% year-on-year at €26,223 million. Decreased financing needs stemming from the slowdown of loans have allowed for the implementation of a selective marketing policy for customer funds, giving priority to low-cost modalities. At the end of December, customer funds showed a balance of €34,169m (including mutual funds), 6.6% higher than in December 2008. Growth was largely concentrated in current and savings accounts (up 19.7%). The assets managed by pension fund managers were up 27.6% year-on-year to €36,104m.

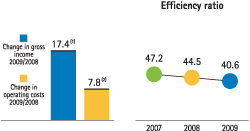

Therefore, the net interest income for 2009 was €2,463 million, for a 15.2% growth year-on-year. It was also a good year for fees and commissions, which were up 9.6% at €836 million. The more traditional lines of business did well and those related to mutual funds and securities improved in the later quarters of 2009. Net trading income stood at €405m, reflecting a positive year on the financial markets. The sale of financial instruments in the banking business generated capital gains and the pension managers and insurance companies reported high returns from proprietary trading. Year-to-end gross income in 2009 reached €3,706m, up 17.4% on the previous year.

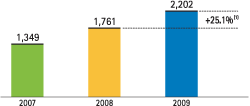

Austerity measures and correct cost management have been key factors during the year. Operating costs were €1,504m. This was 7.8% higher than the previous year and substantially below the average regional inflation rate. This moderation in expenses and positive revenue growth meant that, as in previous years, the cost-income ratio improved, reaching 40.6% as against the 44.5% reported in 2008. Operating income rose 25.1% over the year, to €2,202m.

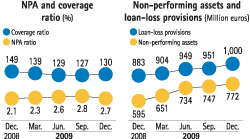

The third characteristic marking the year was the strict policy applied to risk acceptance and the success of the recoveries policy implemented by the area’s units. This considerably curtailed the impact of the crisis on asset quality. Thus, the 2.7% year-end NPA ratio remained quite close to the 2.1% reported in 2008. Coverage remained high, at 130%. In 2009, losses from impairments on financial assets grew 17.6% year-on-year to €419m.